What You Need to Know About SBA Form 3508S

by David Klemt

Midway through last month, the Small Business Administration maneuvered to make the PPP loan forgiveness process simpler for loans up to $150,000.

In December of 2020, Congress passed a Covid-19 relief bill that pumped $284 billion into the Paycheck Protection Program.

Twelve billion dollars were made available to minority-owned and “very small” businesses, and $15 billion were made available to independent movie theaters, live music venues, and cultural institutions.

What is SBA Form 3508S?

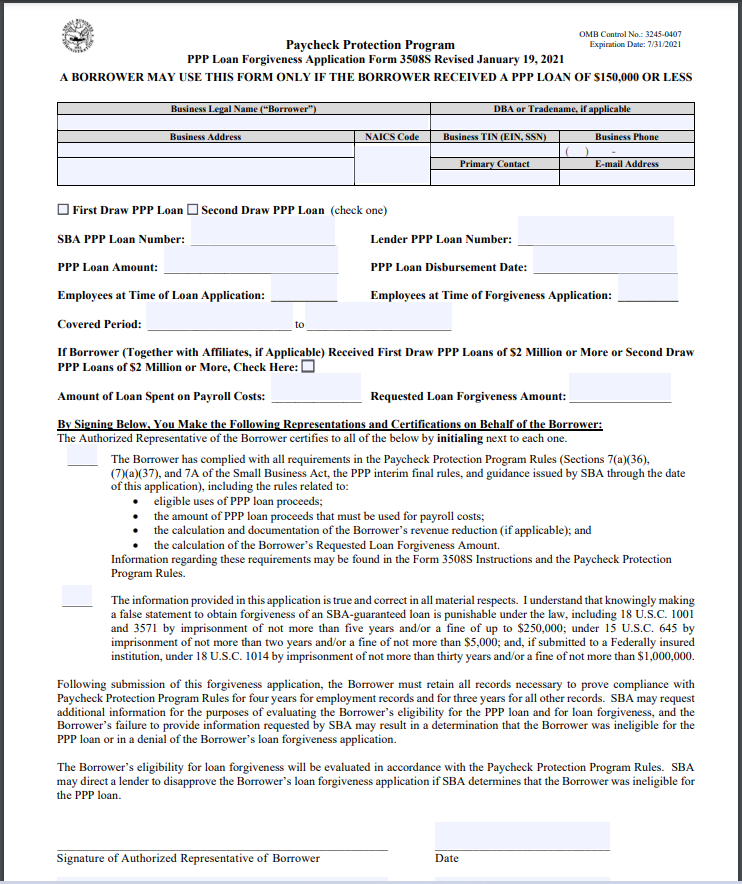

Simply put, 3508S is a simplified, one-page PPP loan forgiveness form.

When Congress passed December’s relief bill, they included a requirement for the SBA to offer streamlined loan forgiveness forms.

To that end, 3508S is for businesses that received loans of $150K or less. Again, it’s a single page. As you’ll see when you check out SBA Form 3508S, the form comes with instructions.

What information do you need to provide?

With Form 3508S, you’re not even filling out an entire page. And the first roughly third is simple. Assuming you’re the person filling out, certifying and signing the form:

- Business legal name (“Borrower”)

- If applicable, the DBA or Tradename

- Business address

- North American Industry Classification System (NAICS) code (Accommodation and Food Services is 72; Arts, Entertainment and Recreation is 71, for reference)

- Business Taxpayer Identification Number (TIN), Employer Identification Number (EIN), or Social Security Number (SSN)

- Primary contact

- Email address

After filling out that section and ticking the box for first-draw PPP loans or second draw, you’ll need the following info:

- SBA PPP loan number

- Lender PPP loan number

- PPP loan amount

- PPP loan disbursement date

- The number of employees at the time of the loan application

- Number of employees at time of loan forgiveness application

- Covered period of PPP loan. Per the form instructions, “The Covered Period begins on the date the loan was originally disbursed. It ends on a date selected by the

Borrower that is at least 8 weeks following the date of loan disbursement and not more than 24 weeks after the date of loan disbursement.” - Total amount of loan spent on payroll costs

- Requested amount of loan forgiveness

From there, you initial two boxes–if you can do so accurately and honestly–next to certification statements. Then you sign, print and the date form and include your title.

There’s an optional demographic information section at the top of page two of Form 3508S.

SBA Form 3508A. Sample only.

What additional documentation must you provide?

None, which is what makes this form so simple. In fact, you’re not even required to show any of your calculations corresponding form sections. However, we strongly suggest you run those calculations as you’ll need to certify that you did so and you’ll need them if the SBA audits the loan.

And while you don’t have to submit additional documents, it’s likewise required and smart that you retain required documentation for a number of years. The SBA may ask for certain documents when your application comes up for review, so you’ll want to know where they are to make the process as smooth as possible.

What’s the loan forgiveness deadline?

There’s no specific date in terms of an SBA PPP loan deadline. However, the SBA’s PPP loan forgiveness FAQ states the following:

- “Borrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from loan origination.”

- “[I]f a borrower does not apply for loan forgiveness within 10 months after the last day of the borrower’s loan forgiveness covered period, loan payments are no longer deferred and the borrower must begin making payments on the loan.

You may notice that Form 3508S has an expiration date of July 31, 2021 in the upper right-hand corner. This simply indicates the SBA’s compliance with the Paperwork

Reduction Act.

There are other SBA PPP loan forgiveness applications as well. SBA Form 3508-EZ is for borrowers who meet specific conditions, and Form 3508D is for borrowers to disclose controlling interests in the business by other companies, along with government officials involved in the business.

If none of those forms are right for you, you’ll have to fill out the standard, five-page Form 3508.

Image: Cytonn Photography from Pexels