Rediscovering Your Guests in 2021

by David Klemt

Labatt Breweries of Canada wants operators to get to know their guests all over again in 2021.

Luckily, this isn’t a massive undertaking. However, it requires commitment and an understanding of altered consumer behavior.

During the 2021 Restaurants Canada Show, Labatt presented “Rediscover Your Guest: The 2021 Consumer.”

Christina Veira, bar and beverage curator for the RC Show, hosted the digital session. Labatt panelists included Michelle Tham, head of education and certified Cicerone, and Megan Harris, director of insights and strategy. Casey Ferrell, vice president of US and Canada Monitors for Kantar Consulting rounded out the panel.

Who’s Your 2021 Guest?

The good news is that Canadians are still consuming beverage alcohol. The less-good news is that they’ve gotten used to drinking mainly at home.

In fact, per Megan Harris, 95 percent of beverage alcohol occasions now happen at home. Harris also says there’s excitement about a return to in-person restaurant and bar service. However, several pandemic-driven behaviors will persist, including:

- Takeout

- Delivery

- Daytime drinking

- Working from home

Guests are set to unleash a torrent of pent-up demand when they can safely return to restaurants and bars. They want to indulge themselves, have fun and new experiences, but also feel safe.

Generally speaking, younger guests are more tolerant of risk. Conversely, guests over 50 years old are more cautious.

Vaccine Influence

Per Ferrell, there are four distinct vaccine groups in Canada and the United States:

- People have gotten a Covid-19 vaccine.

- People who can’t wait to get a Covid-19 vaccine.

- People who are unsure about Covid-19 vaccines.

- People who refuse to get a Covid-19 vaccine.

Ferrell says to remove the final group on that list. Doing so shows that about two-thirds of Canadians (and Americans) are in the process of getting the vaccine. Therefore, operators need consider how to address vaccination safety along with vaccination requirements for guests and employees. For Ferrell, the best lever to pull is the one that addresses Covid-19 and vaccine risks.

Additionally, just because the calendar ticked over to 2021 doesn’t mean everything is different. Accordingly, Ferrell feels that Q1 is the “More of 2021” stage of this year. He expects people to open up their bubbles during possibly Q2 or Q3, the “Less Covid-19” stage. Parties that include multiple households will return in force in Q4.

How to Meet 2021 Guest Expectations

First, we must be cautious when people return to restaurants, bars and other venues en masse. That initial boost in traffic driven by pent-up demand will ebb quicker than one would expect.

To get people through the doors, operators will need to focus on:

- health and safety;

- staff expectations and training;

- social interactions and the joy deficit; and

- guest experience and journey.

Harris sums up the first point succinctly: Anything that can be touchless, should be touchless. Operators should expect contactless features to remain moving forward. The expectation for hygiene will also remain. Guests will want to see employees cleaning and sanitizing, for instance.

Speaking of employees, operators must address the role they’ll plan in crowd management. Unfortunately, management and employees will have to be ready to enforce health and safety protocols strongly.

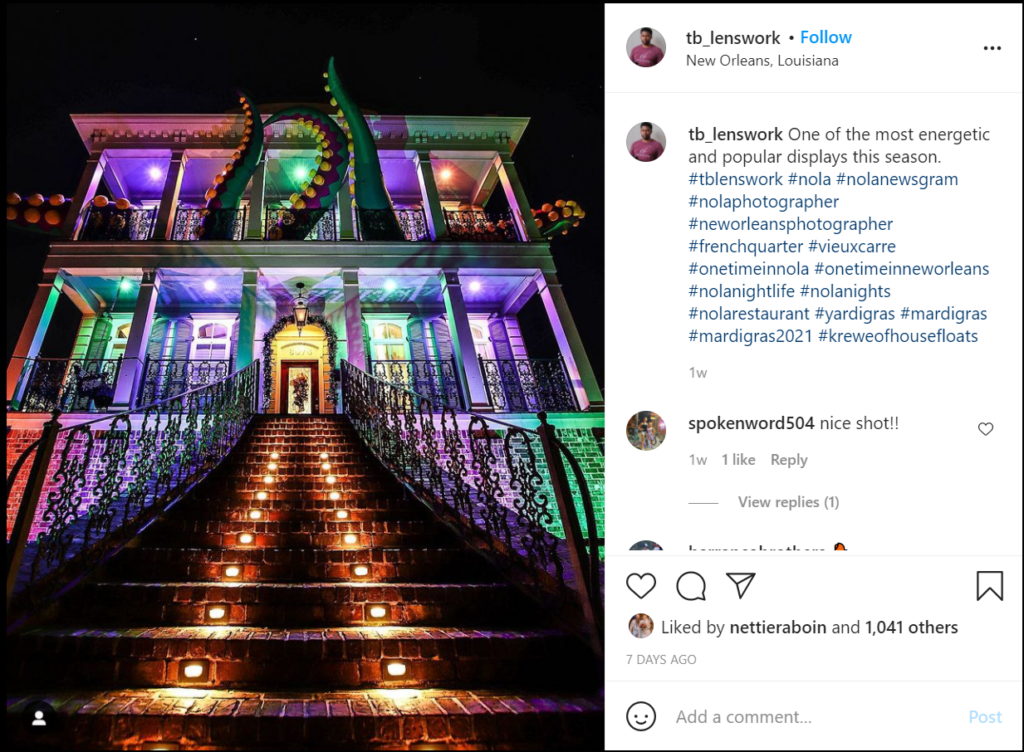

As Ferrell notes, long-term lockdown means large swaths of the population need to re-learn how to interact with others. One way to drive guests through restaurant or bar doors is promoting the role they play in socializing. Hospitality businesses facilitate social interaction—it’s one of the industry’s greatest strengths. Equally, restaurants and bars fill people’s joy deficits.

Operators, says Harris, need to consider:

- every way they can offer an experience guests can’t have at home;

- how they can capitalize on the daytime drinking experience;

- how to extend the guest experience—pre-visit and post-visit;

- how to attract older guests to their venues;

- leveraging patio spaces; and

- focusing on messaging that promotes escapism and excitement.

Another interesting consideration concerns table distances. Every operator needs to weigh square feet per guest and distancing tables. Social distance will likely remain important to guests for at least a little while post-pandemic.

Bonus

Ferrell answered a question I asked about Las Vegas specifically. Dayclubs, which largely focus on elevating pool parties, are an integral part of Vegas hospitality.

So, how can they signal their commitment to health and safety as relates to infections?

Ferrell’s answer is that evidence appears to indicate that pools are Covid-19 infection spreaders. Therefore, dayclub operators should focus more on the crowd control aspect of health and safety. Additionally, messaging should focus on indulgence.

After all, says Ferrell, not much is more indulgent than saying, “I’m going to take the day for myself and go to a daylife venue.”

Image: Nick Hillier on Unsplash