Taco Bell Celebrates Taco Tuesday Win

by David Klemt

Taco Bell, fresh off their victory in petitioning for the cancellation of the “Taco Tuesday” mark, will open a $5 million taco tab on September 12.

There’s no arguing that over at least the past few years Taco Bell has become the master of LTOs and attention-grabbing, loyalty-strengthening, and headline-generating promotions.

This campaign further solidifies the brand’s status as king of the fast-food campaigns.

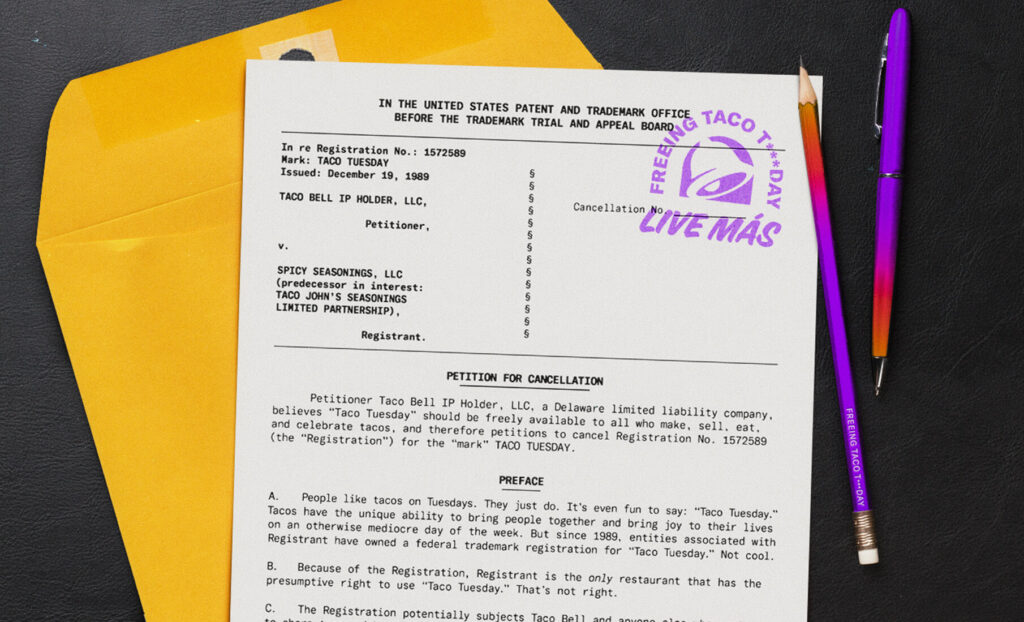

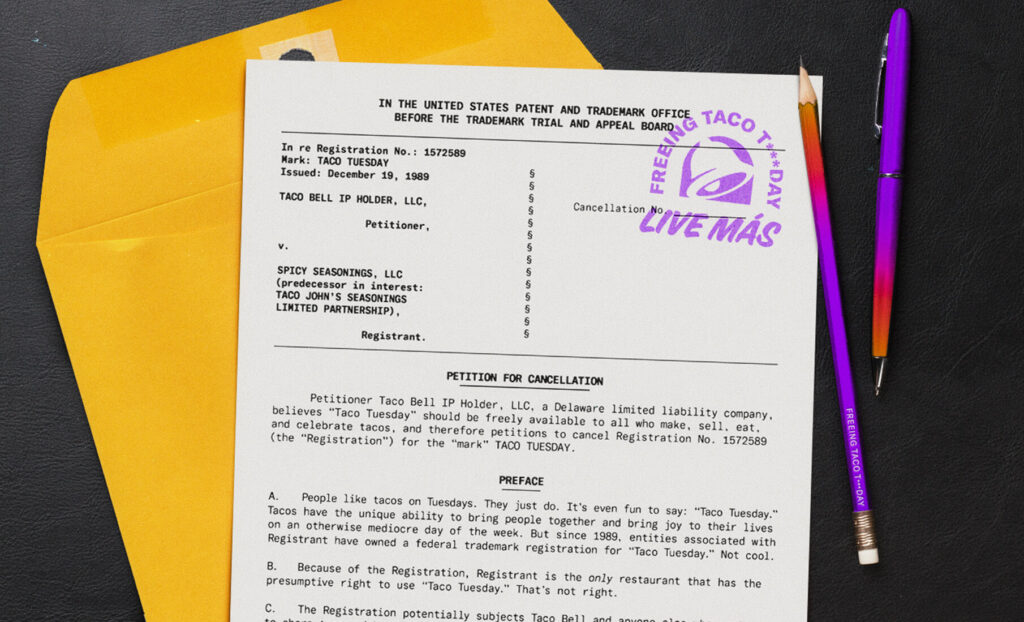

“Taco T**sday” to “Taco Tuesday”

It’s highly unlikely that consumers and operators alike are unaware of the company’s “Taco T**sday” ads. The campaign, while playful, put a spotlight on the fact that, until recently, “Taco Tuesday” was a registered trademark.

Rather than spend millions of dollars to fight Taco Bell, Taco John’s, who previously had the rights to the mark, opted to relinquish the rights to the mark. Taco Bell’s argument was that nobody should be permitted to mark a common phrase.

“We’ve always prided ourselves on being the home of Taco Tuesday, but paying millions of dollars to lawyers to defend our mark just doesn’t feel like the right thing to do,” said Jim Creel, Taco John’s CEO. “As we’ve said before, we’re lovers, not fighters, at Taco John’s. So in that spirit, we have decided to begin sharing Taco Tuesday with a pledge to contribute $100 per location in our system to restaurant employees with children who are battling a health crisis, death or natural disaster. And we’re challenging our litigious competitors and other taco-loving brands to join us in supporting the people who serve our favorite food to guests across the nation.”

In fact, Creel fired a shot across the bow at Taco Bell at other rivals. After announcing their pledge to CORE, the CEO challenged other brands that want to use “Taco Tuesday” to do the same. The result would be quite the donation, considering that Taco John’s operates 400 restaurants in 21 states and Taco Bell alone operates more than 7,200 in the US. Look overseas and that number jumps up by about 1,000 locations in 30 countries.

Taco John’s has reportedly made good on their pledge, donating $40,000 to CORE, Children of Restaurant Employees.

What’s in a Mark?

Fast-food chain Taco John’s trademarked the phrase back in 1989. However, back in 1984, a California-based restaurant, Tortilla Flats, registered the trademark. According to some sources, the mark lapsed and Taco John’s snapped it up. That said, Tortilla Flats has sued other California restaurants for using the phrase throughout the years.

Interestingly, Taco John’s only had rights to the mark in 49 states. The exception is New Jersey, where Gregory’s owns the trademark. In fact, anyone who visits their site (as of the publication of this article) will see the phrase “Home of the Original Taco Tuesday!” right at the top.

However, it may surprise some to learn that a celebrity who appeared in Taco Bell’s “Taco T**sday” ads attempted to trademark the phrase in 2019. That celebrity? None other than Lebron James.

Clearly, this seemingly simple two-word phrase is a valuable trademark. It’s also likely that plenty of restaurants across the US have been surreptitiously using the phrase to drive traffic to their venues on Tuesdays for years.

The fact that Lebron James showed interest in the trademark and Taco Bell likely spent millions of dollars in ad revenue to have Taco John’s mark canceled shows the value. Time will tell how many millions of dollars the phrase will be worth to Taco Bell and other restaurant brands across the US.

Taco Tab

Some will see Taco Bell’s campaign as a massive brand bullying a smaller rival. Others will agree that it’s unfair for anyone to own the rights to such a common phrase.

In terms of exposure, I think this battle will help Taco John’s experience further growth. Last year was a banner year for growth for the franchise, and the brand was seeing growth back in 2021 as well.

After doing some digging, I learned that seven Taco John’s locations are owned by corporate; the plan for 2023 is to go from 375 stores to 400; and another 20 to 25 locations are planned for 2024. Per the Taco John’s website, initial layout for a franchise is between $942,000 and $1.4 for a single unit. A single franchise location generates annual revenue of around $1.2 million, on average.

Regarding Taco Bell, the brand is celebrating their victory—framed as a victory for all restaurants—with another of their famous and effective LTOs. On August 15, August 22, August 29, and September 5, Taco Bell guests can score a free Doritos Locos Taco. But the big celebration comes on September 12.

For that upcoming Taco Tuesday, Taco Bell will open a $5 million tab with DoorDash across the United States, with the exception of New Jersey. Again, Gregory’s owns the rights to the “Taco Tuesday” mark in the Garden State.

On September 12, Taco Bell will cover a portion of orders placed through the third-party delivery app to participating restaurants that offer Mexican cuisine. This does help the fast-food titan make the case that they fought this battle not just for themselves but all foodservice brands that wish to use the phrase “Taco Tuesday” without fear of legal action.

For further information, read the official Taco Bell press release below.

TACO BELL WILL HELP PAY FOR YOUR TACO TUESDAY CELEBRATION — EVEN IF IT’S NOT AT TACO BELL

Irvine, Calif. (August 8, 2023) – To celebrate the liberation of the Taco Tuesday trademark registration in 49 states, and to support and spotlight restaurants who now have the right to freely use Taco Tuesday, Taco Bell has announced that on Tuesday, September 12, Taco Tuesday fans (nearly) everywhere* can celebrate Taco Tuesday (nearly) anywhere – and Taco Bell will help pay for it.

On Taco Tuesday, September 12, Taco Bell, in partnership with DoorDash, is opening a $5 million taco tab to cover a portion of taco fans’ orders from any participating vendor selling Mexican cuisine. Because now that Taco Tuesday is free* – your tacos should be, too.

Leading up to the September 12 celebration, all Taco Bell locations will be offering a free Doritos® Locos Taco every Tuesday, no purchase necessary, on 8/15, 8/22, 8/29 and 9/5**.

“Taco Tuesday belongs to all who make, sell, eat and celebrate tacos, and this Free-For-All will not only thank taco fans who supported the cause, but will also spotlight local restaurants and vendors who can now embrace Taco Tuesdays without fear of legal action,” said Taco Bell U.S. Chief Marketing Officer, Taylor Montgomery. “When tacos win, we all win. We all win when Taco John’s decides to release its trademark registration, we all win when taco vendors everywhere are free to join the movement, and we all win when taco fans can freely celebrate and support Taco Tuesdays at Taco Bell or anywhere else.”

The Road to Freeing Taco Tuesday

In May 2023, Taco Bell took a bold step on behalf of taco lovers nationwide by filing legal petitions to cancel the two Taco Tuesday trademark registrations. The aim was simple: to free the phrase for restaurants nationwide. The message was clear: Taco Tuesday belongs to everyone, from Taco Bell to Taco John’s to your favorite local taco spot.

In late July, Taco John’s courageously decided to abandon its Taco Tuesday trademark registration. Not only did Taco John’s act benefit thousands of businesses across 49 states by making the term Taco Tuesday more freely available, Taco John’s also made a meaningful donation to Children of Restaurant Employees (CORE) for $40,000, which the Taco Bell Foundation has matched.

Supporting The Taco Community

Taco Bell has also committed to donating $1 million in partnership with the Taco Bell Foundation to support young people who make, sell, eat and celebrate tacos. Donations made by Rounding Up at checkout on Tuesdays will be matched up to $1 million. These donations will continue to fund the Taco Bell Foundation’s Community Grants and the Live Más Scholarship for fans and team members.

*The Taco Tuesday trademark registration has been canceled in all states except New Jersey. Therefore, the DoorDash offer will be limited to the 49 states where Taco Tuesday has been freed.

**NO PURCHASE NECESSARY. Offer valid on Tuesdays 8/15, 8/22, 8/29, and 9/5 only during local store operating hours while supplies last. Limit one (1) regular Free Seasoned Beef Nacho Cheese Doritos®

Locos Tacos per person, per offer day, available at participating U.S. Taco Bell® locations only. Not available with delivery orders unless placed directly on the Taco Bell app (delivery fees, taxes and tip apply). App and web orders require inputting offer code and customer must add a DLT to their cart. Not valid with any other offer. No substitutions. No cash value. Void where prohibited. Terms: ta.co/terms.

About Taco Bell Corp.

For more information about Taco Bell, visit our website at www.TacoBell.com, our Newsroom at www.TacoBell.com/news or www.TacoBell.com/popular-links. You can also stay up to date on all things Taco Bell by following us on LinkedIn, TikTok, Twitter, Instagram, Facebook and subscribing to our YouTube channel.

Images: Taco Bell