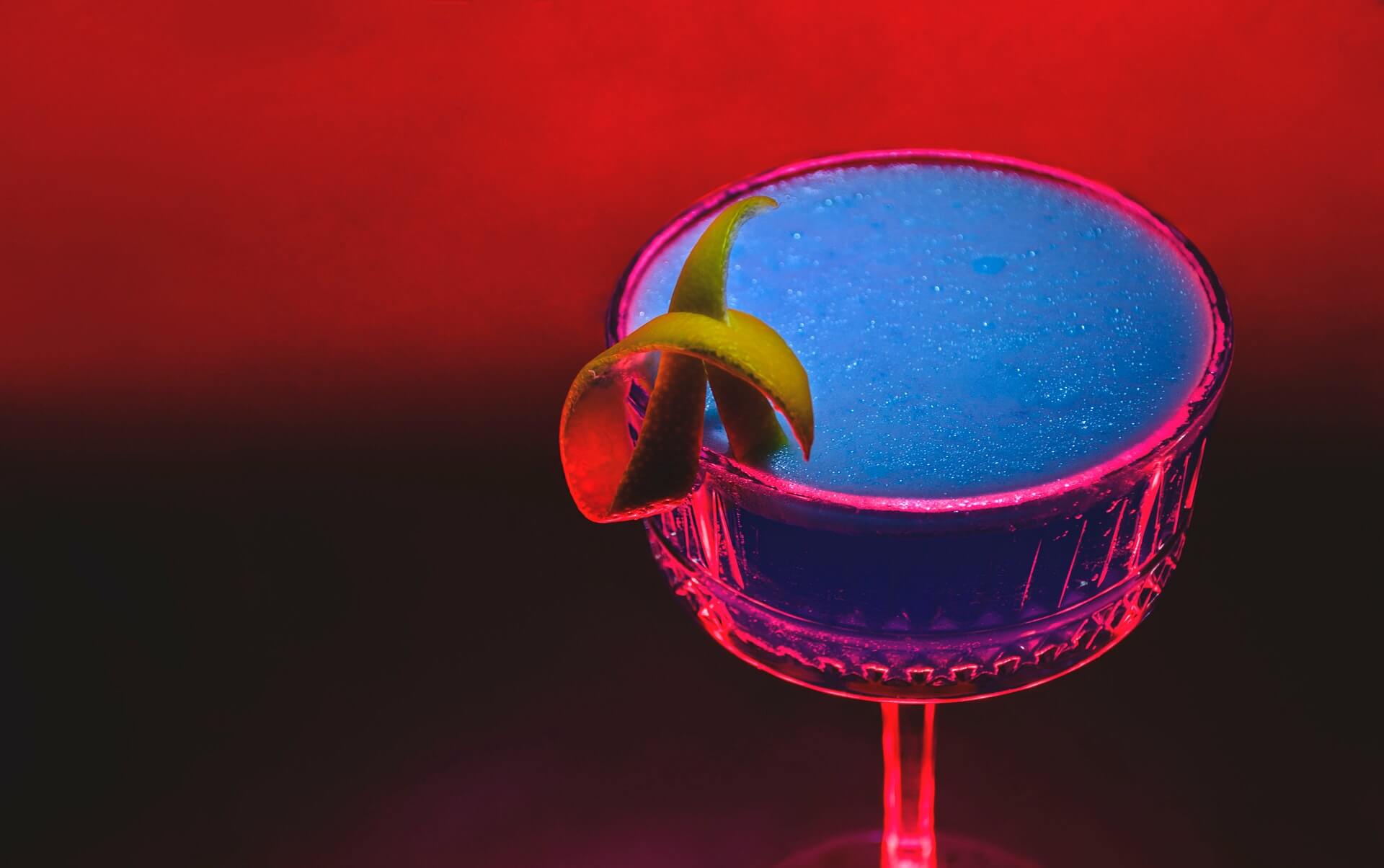

People Aren’t Done ‘Improving’ the Negroni

by David Klemt

It’s possible the infamous Sbagliato Negroni is just the opening salvo from bartenders hell-bent on taking on the traditional specs and build techniques.

Two “new” versions appear to be getting attention now. One is essentially a reverse cocktail. Additionally, it’s likely only really a “new” drink to North Americans.

The other, well, it’s something else entirely. Let’s take a look.

The Mariano, a.k.a the Marianito

This is the Negroni cocktail that’s probably new only in the sense that many North American drinkers are just now hearing about it. In Northern Spain, this is a go-to summer cocktail.

It’s also, like many reverse cocktails, low-ABV and therefore rather sessionable. Further, the Marianito is an excellent ambassador for aperitivo culture.

To be fair, we probably shouldn’t be so reductive and refer to this cocktail as a Negroni riff. So far, I’m unable to uncover the story of its genesis, so I don’t know if the Negroni even inspired the Marianito.

After doing some digging, though, the Marianito apparently first appears in print in 1989. However, some people believe the drink likely traces its origins back to the 1950s. There are also two prevailing origin stories that focus on the name because…of course. This is how so much of cocktail history goes, and I love it.

One story is that “Mariano” is a portmanteau that combines the names of the most popular vermouths in Spain: Martini and Cinzano.

The other story? A waiter who drank little glasses of vermouth (often with a splash of gin or Campari) fell in love with the daughter of someone named Mariano. She didn’t feel the same way, locals in the area found, and they referred to his little drinks as “Marianitos,” after his father-in-law who never was. Not very nice, but alright.

At any rate, the Marianito is a popular summer cocktail. It’s also a year-round drink for many in Northern Spain. Particularly, apparently, in the port city of Bilbao. It’s also a cocktail that is often riffed on, so it lends itself to experimentation.

A Marianito Recipe

Notice this says “a” recipe, not “the” recipe. I’ve come across a few different builds claiming to be the “right” specs.

Some people add 50ml of sweet vermouth, some add 75ml. There are builds that call for vermouth rosso, and those that call for sweet vermouth.

That tells me one thing: bars in Northern Spain like to try and make the Marianito their own. So, experimentation is encouraged.

However, try the specs below before playing around with your Marianito:

- 75ml Sweet vermouth

- 15ml Campari

- 15ml Gin

- 2-3 dashes Angostura bitters

- (Optional) 15ml Pomelo juice

- Orange twist and an olive to garnish

The Sushi Rice Negroni

This…is exactly what it sounds like. When building a classic Negroni, you add sushi rice when mixing it.

The theory is simple enough to understand: sushi rice “softens” the flavors of other ingredients. So, adding sushi rice to your build should soften or “round out” the flavors of your Negroni.

Before we get too far, no—the rice doesn’t end up in the glass.

For this technique the bartender adds anywhere from a few grains to two tablespoons of cooked sushi rice to a mixing glass. After that, the build is the same as the standard cocktail, including the final step: straining into a glass over large ice cube.

Interestingly, bartenders can play with using uncooked or cooked sushi rice. Theoretically, this would adjust how much “softer” the drink turns out. And, of course, proponents of this technique say it can be beneficial to cocktails beyond the Negroni.

However, at the moment, it appears that the Negroni once again finds itself as the subject of experimentation. I can only imagine what else bartenders will subject it to before the year’s end.

So, will you and your bar team try the sushi rice technique?

Image: Tim Durand on Pexels