Summer of White Claw 2.0?

by David Klemt

White Claw is ready to leverage the surge in pent-up consumer demand to get out and party this summer with their latest innovation, Surge.

The new expressions are notable for several reasons. The most obvious, of course, is that they ring in at 8.0% ABV.

Odds are strong that we may be on the verge of a Summer of Surge.

Summer of White Claw 2.0

Let’s look back at the brief but bold history of White Claw.

Imagine it’s 2016. Hard seltzer isn’t quite the powerhouse beverage category that it is today. There’s no snappy, “Ain’t no laws when you’re drinking Claws,” tagline. Neither is there a “ClawLife” hashtag…yet. However, White Claw launches.

Fast-forward to 2018. Fanatics are sharing their devotion to White Claw all over social media. They’re tagging posts #ClawLife. The memes are everywhere, as are the white cans of hard seltzer.

That leads us to 2019. It almost seems simpler to ask what Big Brands aren’t trying to copy White Claw’s success. Try as they might, nobody dethrones King Claw.

Summer 2019 is the Summer of White Claw. The brand essentially singlehandedly grows hard seltzer into the powerhouse beverage category it is today.

In 2021, the hard seltzer kingpin certainly seems set to take over summer once again with White Claw Surge Cranberry and White Claw Surge Blood Orange.

Surging Forward

White Claw Surge’s higher ABV—a boost from 5.0% to 8.0%—isn’t the only departure from the “standard” Claws.

Surge is available only in 16-ounce cans, whereas standard White Claw comes in 12-ounce cans and tall boy versions are 19.2 ounces.

Another big difference? Standard White Claw flavors in 12-ounce cans contain 100 calories. Surge, with 220 calories, has more than twice that amount.

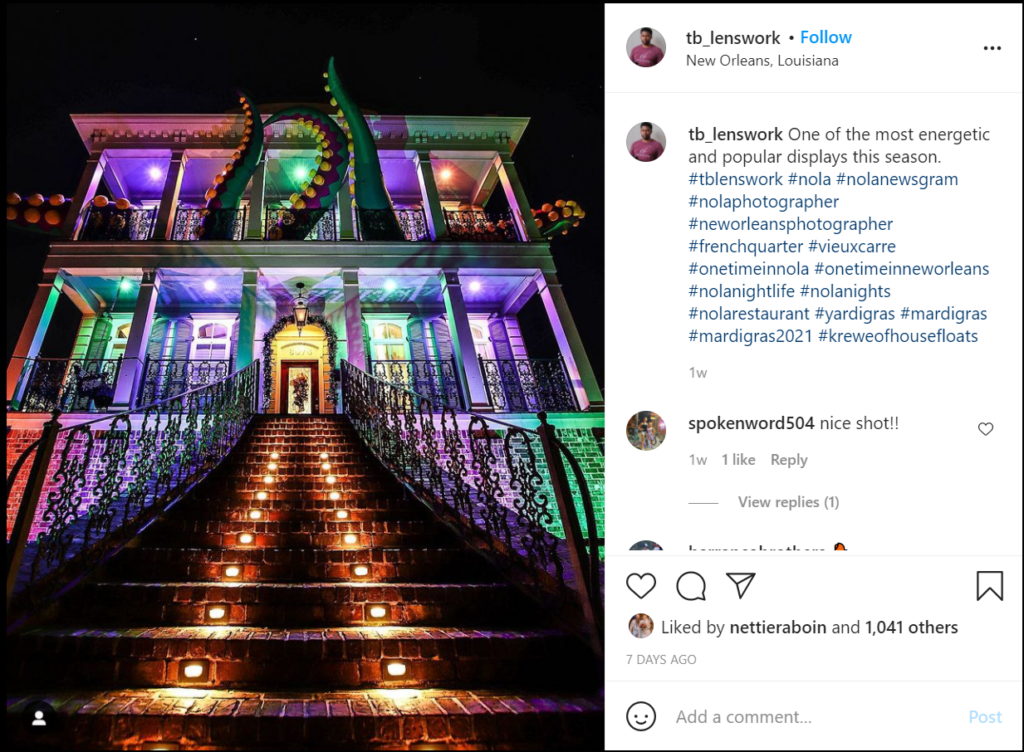

View this post on Instagram

Should White Claw Surge perform as expected, it will represent an interesting evolution in hard seltzer. For many, hard seltzer is a stand-in for beer and other beverage alcohol options because of its low calorie count. If higher-proof, high-calorie hard seltzer becomes popular, it’s a notable shift in consumer behavior.

#ClawLife 2.0

Surge isn’t the only innovation coming from White Claw in time for Summer 2021.

The new White Claw Iced Tea flavors will likely prove to be a popular refresher as the weather gets warmer. These expressions—Lemon, Raspberry, Mango, and Peach—are 100 calories and 5.0% ABV (in 12-ounce cans) like standard Claws.

There are also three new expressions of White Claw available in Variety Pack Flavor Collection No. 3: Strawberry, Pineapple, and Blackberry.

With all of these new hard seltzers on the market and pent-up consumer demand, it’s difficult to see how we’re not headed toward Summer of White Claw 2.0.

Image: White Claw