Stand Out with Weird Holidays: April

by David Klemt

Want to stand out from from other restaurants and bars in your area? Then commit to keeping it weird.

Several “holidays” are set against every date on the calendar. They range from mainstream to food focused to weird.

Focus on the latter to raise eyebrows, carve out a niche for your restaurant or bar, and attract more guests.

Of course, you shouldn’t try to celebrate every holiday, weird or otherwise. Focus on the days that are authentic to your brand; resonate with your guests; and help you grab attention on social media.

April 14: National Reach as High as You Can Day

This is a holiday that will likely work best on social media. Just like there’s always a holiday and people like to say “there’s always a tweet,” there’s always a hashtag.

Use this day (and its accompanying hashtag) to highlight staff who want to participate, along with your venue.

Of course, if you want to involve your guests in person, go for it. Put your head together with your staff and get creative.

April 15: National Take a Wild Guess Day

You can take promotions centered around this day in several directions. The simplest way is to use the holiday to engage with followers on your social channels.

Consider borrowing from the “wrong answers only” posts on Instagram. Post a blurred, pixelated or “censored” item, like a bottle. In the caption, ask followers to “guess” what it is—wild guesses only.

This holiday also works well with blind tasting events.

April 16: Wear Pajamas to Work Day

I’d say this holiday is fairly self-explanatory. Let your front-of-house staff participate by wearing pajamas, with full team buy-in. Or, encourage your guests to wear their pajamas to your restaurant or bar.

If this holiday fell on a Saturday or Sunday, this would be a great day for a brunch promo. Of course, there’s nothing to say you can’t execute a Friday brunch.

April 16: National Bean Counter Day

In the United States, this holiday is taking place a month before the Tax Day deadline. If you’re so inclined, you could offer a deal to all the tax preparers and accountants in your area.

Although, you can also go a completely different direction. You can fill a large jar with beans—coffee would be great—and have guests guess how many there are. You can even post the jar full of beans to social, encouraging follower engagement. Closest guess wins a prize.

April 22: National Jelly Bean Day

Oh, hey… Remember that bean-counting holiday from way up there? I wonder if that bean-guessing idea would work for this holiday…

April 23: National Talk Like Shakespeare Day

If you think you or your social media manager can handle it, encourage your followers to describe your restaurant or bar as though they’re the Bard himself.

Or, as a Shakespearean translator would explain it, “Encourageth thy followeth’rs to describeth thy restaurant ‘r bar as though those gents’re the Bard himself.”

April 25: National DNA Day

Yesterday, I shared how our DNA plays a significant role in how we perceive bitter flavors. National DNA Day would be a great time to plan and execute a PTC strip and cocktail event.

April 27: National Tell a Story Day

How well do your loyal guests know you and your brand? How well do they know your staff?

National Tell a Story Day is an excellent time to leverage the story features on your social channels. Show off the venue and tell your brand’s story. If you have team members who want to participate and tell share a story, that’s a great way to engage with followers and guests.

April 28: National Superhero Day

If there was a ever a day to encourage your staff and/or guests to dress up for a fun time… National Superhero Day also leverages Shudder’s “Halfway to Halloween” event.

To take this holiday in another direction, you can also celebrate members of your community who give back to others by giving back to them.

“Weird” holidays aren’t just a dynamic way to engage with guests. Asking your team for ideas for holiday promotions is an excellent way to keep them engaged, which is a smart way to retain staff.

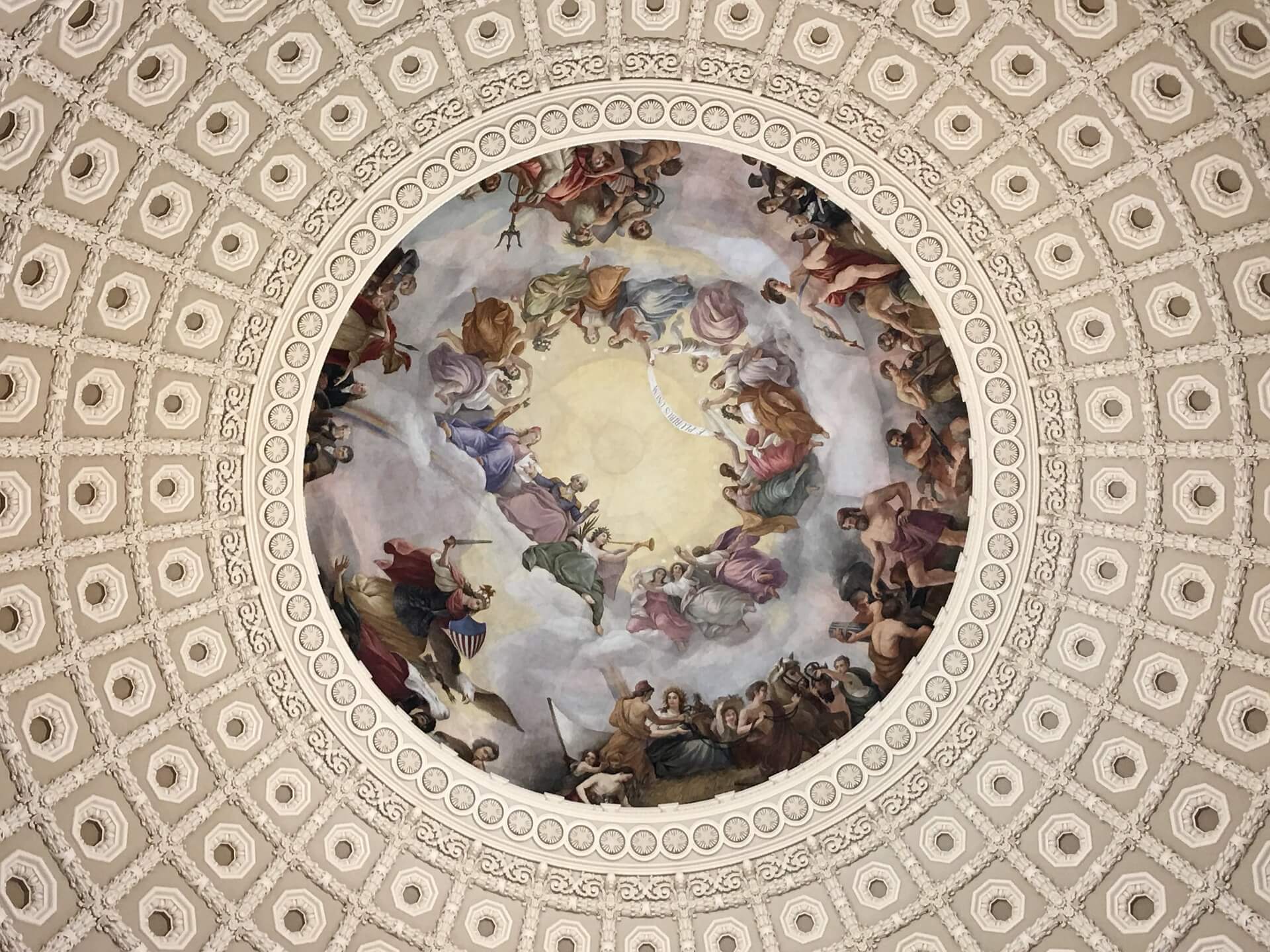

Image: Dan Parlante on Unsplash