Why KRG Hospitality Offers Tech-stack Planning

by David Klemt

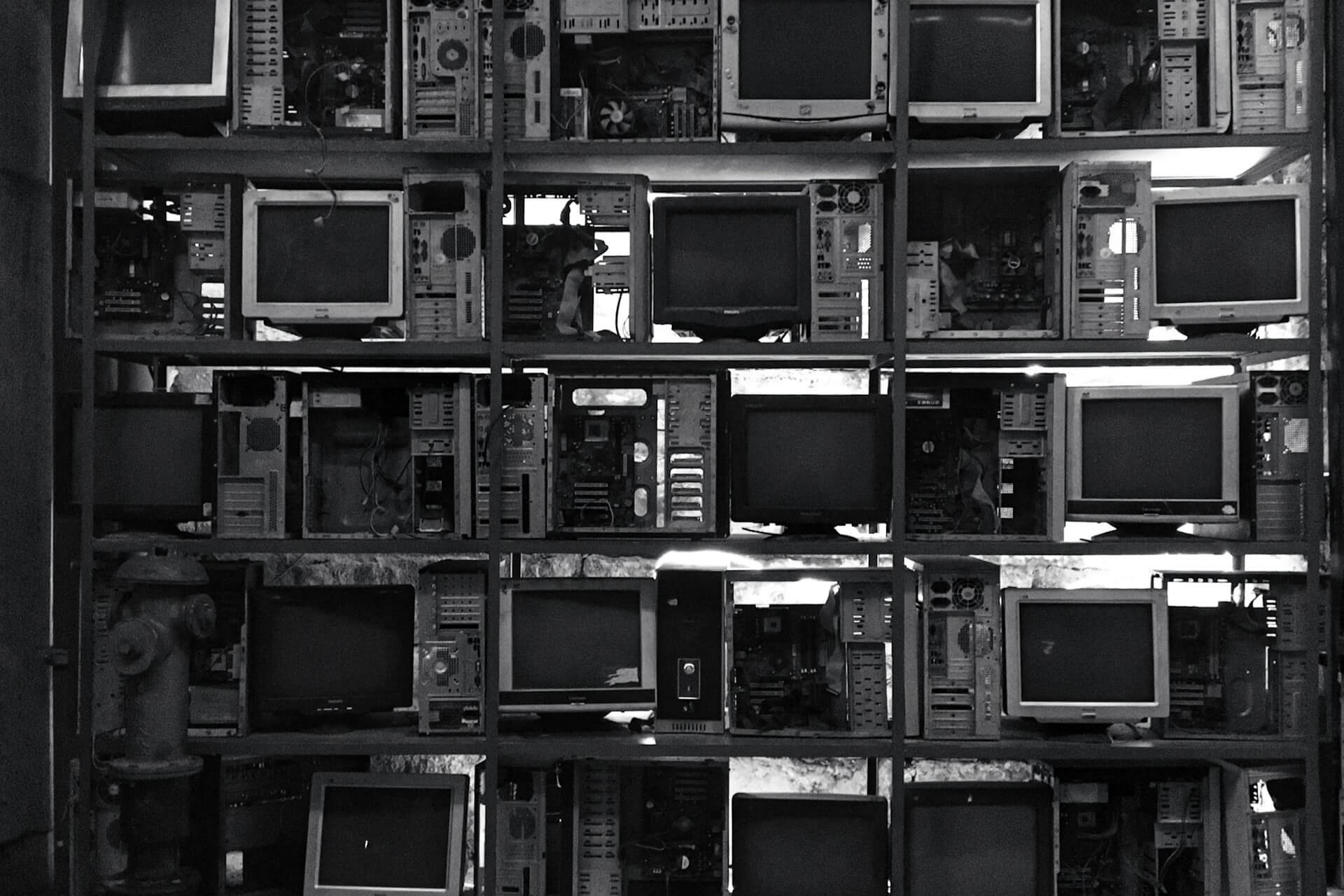

If your hardware looks like this, it may be time to update your tech stack.

Navigating the seemingly endless restaurant, bar, and hotel technology options available to operators can feel like an overwhelmingly complex task.

This can be particularly true for brand-new operators and those with a decade or more of experience under their belts. For the former, where does one with little to no experience even begin putting together their technology stack?

And for the latter, what tech upgrades are worth implementing, and which platforms are crucial; which are nice to have; and which are unnecessary for a particular concept?

Sitting down and sifting through the platforms within just a few categories can be a significant investment of time. Learning to use each solution and training relevant team members on them also requires considerable time and effort. That’s to say nothing of the initial and monthly outlay of precious monetary resources after making selections.

Of course, there’s also the nagging feeling that maybe the platforms chosen aren’t the “right” fit, or the best in class.

Most operators, regardless of the length of time they’ve been in hospitality, are aware of a handful of tech selections they need to make. They know they need a point-of-sale system, a customer relationship management option, an online ordering platform, a reservation system.

But what about inventory, gratuity management, marketing campaign management, guest feedback, scheduling, catering, website chatbots, AI-enhanced loyalty programs, and even kitchen displays?

According to Brizo Foodmetrics, operators need to consider a dozen tech categories. At KRG Hospitality, we say there are at least that many.

Difficult Choices

Per a new report from Nation’s Restaurant News, people are excited but cautious about the tech available to the hospitality industry. Anyone interested in reviewing the 2024 Restaurant Technology Outlook report can click here to gain access.

Among the report’s insights are the identification of a number of challenges operators face when it comes to tech decisions. The most-significant barrier is still pricing, with 37 percent of NRN survey respondents saying hardware comes with high costs. Further, 30 percent think there’s not enough transparency surrounding additional fees.

There’s also an interesting perception as regards features. While 33 percent of respondents feel the systems they’ve selected are light on functionality, 18 percent say their systems have functions that they don’t even use.

Thirty-two percent of survey respondents identify a lack of knowledge of systems as a barrier to adopting new tech solutions. In some good news, just ten percent of respondents say systems are too difficult to use. Still, ten percent of our industry is a significant number.

Combined, 87 percent of those surveyed will either possibly (24%), probably (33%), or definitely (30%) invest in tech in 2024. That’s an impressive number.

However, 39 percent of respondents were “definitely” going to invest in tech in 2023. That’s a drop of nine percent.

Here to Help

When we at KRG develop a tech stack for a client, it’s with their specific project and needs in mind.

And while we do have preferred partners, we present multiple options. Moreover, each option comes with a synopsis of features and a justification for its inclusion.

If a preferred partner isn’t the best option or the client wants to choose something else, we support that decision. Tech is challenging enough already without being steered toward specific platforms for no other reason than, “We like this one.” These decisions aren’t about us, they’re about what’s best for our clients.

At the end of each tech-stack plan are estimated costs for each option. We include the onboarding fees, monthly fees, and the annual cost. Again, these are close estimates as modules, additional features and hardware like handhelds, and subscriptions can increase or reduce the overall cost.

The hospitality industry tech landscape is transforming from a barren desert to a thriving wetland. KRG Hospitality is here to help you navigate this complex terrain.