Chicago to Phase Out the Tip Credit

by David Klemt

In a move that some are celebrating and others claim will kill jobs, Chicago will phase out the tip credit incrementally by the year 2028.

Currently, pay for tipped workers amounts to 60 percent of the minimum wage. Starting next year, that will change.

Beginning July 1, 2024, tipped workers will earn eight-percent increases on an annual basis. This will continue until July 1, 2028. On that date, tipped workers must receive the full minimum wage.

Put another way, the city of Chicago will eliminate the tip credit entirely midway through 2028. To add clarification, this phasing out of the tax credit applies to all 77 of the city’s neighborhoods.

Overwhelmingly, Chicago’s City Council voted for the so-called “One Fair Wage Ordinance.” Thirty-six alderpeople voted “yea,” while just ten voted “nay.”

As one would expect, not everyone is happy that the ordinance was passed on Friday, October 6. Nor are they pleased that Mayor Brandon Johnson signed off on the bill a week ago today.

Specifically, Alderman Nicholas Sposato referred to the One Fair Wage Ordinance as a “job and business killer.”

Further, as reported by Restaurant Dive last week, the Illinois Restaurant Association opposes the decision to eliminate the tip credit in Chicago.

“We wholeheartedly disagree with the decision to move forward with the elimination of the tip credit,” Restaurant Dive reports a representative of the IRA saying in a statement emailed to the publication.

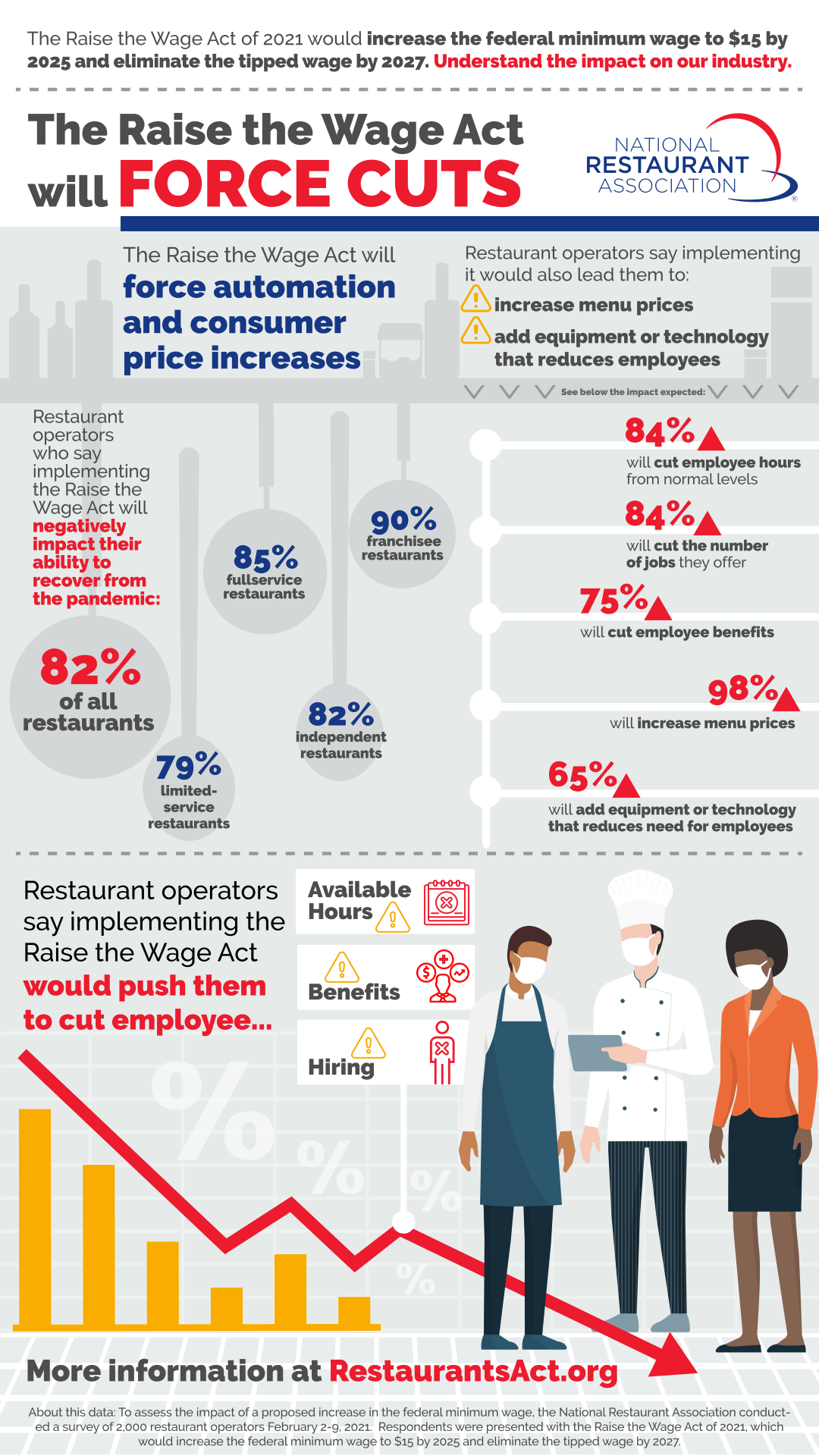

The National Restaurant Association also opposes the ordinance, reportedly vowing to fight any such legislation that introduced throughout the country.

However, One Fair Wage and the Service Employees International Union are celebrating the plan to phase out the tip credit. However, the SEIU would like the elimination to apply statewide.

A Compromise

Attempting to negotiate for legislation they found more palatable, the IRA had proposed a different approach.

Their version would have seen tipped workers make a minimum of $20.54 per hour. However, that ordinance would only have applied to restaurants that generate $3 million or more in annual revenue. Additionally, the IRA proposed tripling fines related to violations of the proposed ordinance.

Had that proposal been accepted, the pay situation would have been unchanged for tipped workers in smaller operations.

In the end, the IRA agreed to eliminating the tip credit over the course of five years to make the transition smoother for operators. This is due, in part, to the possibility of a two-year phasing out of the tip credit being passed by Chicago’s City Council.

The IRA, NRA, and others who oppose eliminating tip credits point to hardships on the operator side. Increased labor costs will lead to increases in menu prices, reductions in traffic and hours, the elimination of jobs, and, ultimately, the shuttering of many businesses.

However, those who support such ordinance point to the financial stability of vulnerable people, and those who work throughout the industry to earn a living wage.

The Future

While Chicago is the largest city in America to vote to eliminate the tip credit, it’s not the first pass such legislation.

The city joins Alaska, California, Minnesota, Montana, Nevada, and Oregon in doing so. Additionally, Washington, DC, will eliminate the tip credit fully by July 1, 2027. Phase one of DC’s tip credit elimination started May 1 of this year.

Of course, the news out of Chicago also comes on the heels of the FAST Act fight ending in California.

These developments beg the question: Which city or state will introduce legislation next, and how will it play out for workers and operators?

Image: Trace Hudson via Pexels