Did This Beer Win Super Bowl LVIII?

by David Klemt

Now that the Super Bowl is over, behavioral insight platform Veylinx is revealing the impact on brands that advertised during this year’s big game.

If Veylinx sounds familiar to you, you may be a regular KRG Hospitality news reader. Last month we looked at their dive into alcohol-free canned cocktails. Last year, we shared a Veylinx report with a focus on whether Super Bowl ads really work on consumers. And in 2022, Veylinx wondered if the interest in zero-proof drinks was all hype or worth leveraging.

This month, Veylinx is at it again. This time, however, they’re revealing which brands—those that advertised during Super Bowl LVIII—saw the biggest ROI. For context, a 30-second spot during the big game cost approximately $7 million this year.

That’s a ton of cash to shell out in the hopes of seeing a sales increase on- and off-premise.

Speaking of on-premise, Veylinx’s findings should be of interest to operators. The beer that Veylinx says “won” the Super Bowl will likely be top of mind among your guests who watched the game and the accompanying ads.

So, it stands to reason that they’ll either expect to find that beer on a menu. Likewise, they may be swayed to order the beer if they see it when scanning a bar’s taps, menu, or fridges.

With that in mind, operators may want to watch their sales of Michelob Ultra.

Study Methodology

For their latest report, Veylinx used similar methodology to their Elixir non-alcoholic canned cocktail study.

A mix of 50 percent men and fifty percent women participated in the study. All 1,604 participants were US residents aged 21 or older. Looking deeper into the participants, the age breakdown is as follows:

- 21 to 27: 30 percent

- 28 to 43: 25 percent

- 44 to 59: 25 percent

- 60 and older: 20 percent

Like the Elixir (a fake brand invented by Veylinx) study, participants bid on products with their own money. The auction mix consisted of products that advertised during Super Bowl LVIII and those that did not advertise during the game.

Study Results

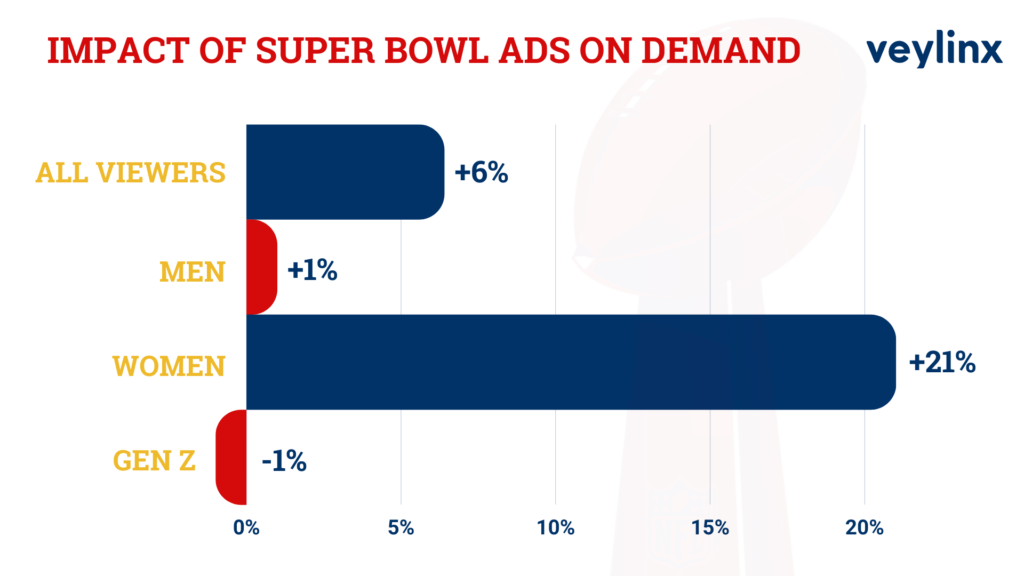

Among all viewers of Super Bowl LVIII, brands that advertised during the game saw an average lift of 16 percent.

However, those brands saw the biggest boost in demand—24 percent—among men. Gen Z followed, with demand in advertised brands growing by 11 percent. Among women, brands that advertised saw just a nine-percent boost in demand.

While Doritos Dinamita was the number-one brand among all viewers in general, and men and Gen Z in particular, Michelob Ultra is a close second. Interestingly, the beer brand was the top-performer among women in terms of demand growth.

For those wondering, no alcohol brands were among the top three performers for Gen Z.

So, operators who have noticed in uptick in Michelob Ultra sales may have Super Bowl LVIII to thank. If that’s the case, if sales of Michelob Ultra have increased in bars and restaurants since this year’s big game, it appears that yes, Super Bowl ads still work on consumers.

Image: cottonbro studio on Pexels