The Difference Between a Plan and a Playbook

by Doug Radkey

Sometimes AI comes up with impressive images. This is one of them.

You’ve likely heard that 80 percent of hospitality businesses fail within the first five years.

When you ask those in the industry the question of why there is such a high rate of failure, they reply with a fairly predictable list of factors. These tend to be location, concept or brand confusion, lack of service standards, toxic workplace culture, sub-par marketing efforts, and mismanaged funds.

Many operators who fail try to quickly blame external factors, such as the economy.

When you ask the next question—what are the other 20 percent of operators doing differently to surpass five years in business—you get one simple answer. The difference between those who drive a sustainable profit of 12, 15 or 20 percent (or more) and those who don’t boils down to one thing and one thing only: they have strategic clarity.

It’s not that the successful 20 percent did not battle challenges or the same tough economy or labor struggles. What they had was clarity, and a playbook detailing how to overcome a multitude of challenges.

So how do you achieve strategic clarity? Well, it’s much more than just writing—or filling out a template for—a business plan.

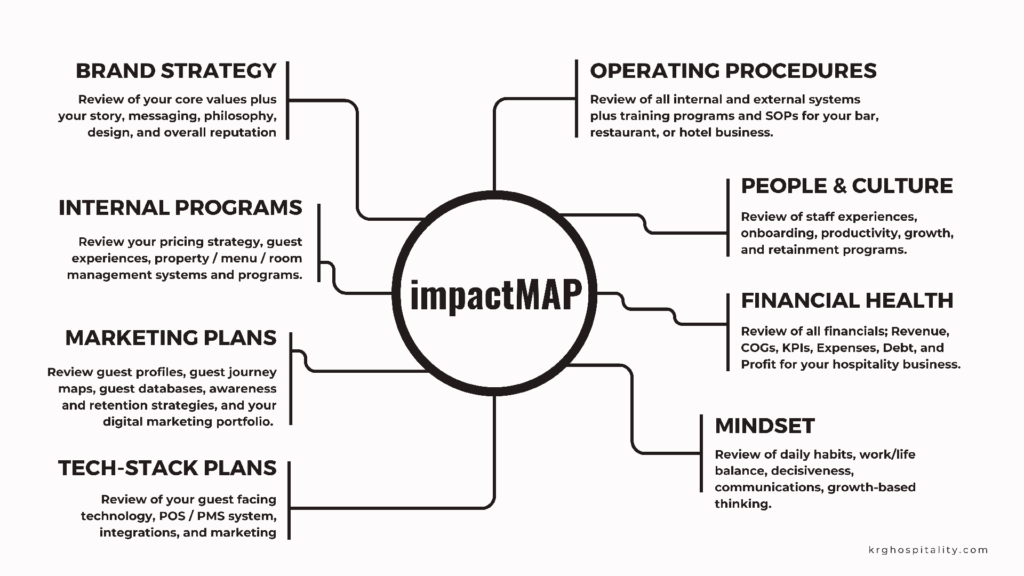

What is Strategic Clarity?

Strategic clarity is the comprehensive understanding and alignment within your hospitality business regarding its identity, direction, purpose, and the means to achieve its goals.

It involves clear communication and consensus on key aspects of the business, ensuring that everyone is working towards the same objectives. Below, the key components that define strategic clarity.

1. Understanding Who We Are

- Core Identity: This includes the mission, vision, and core values of your business. It defines what the business stands for, and its fundamental purpose.

- Strengths and Weaknesses: Recognizing the business’ strengths, weaknesses, opportunities, and threats (SWOT) aids in identifying the core competencies and areas for improvement.

- Culture: The shared beliefs and practices that characterize the business’ internal environment, and how it interacts with both staff and guest perceptions.

2. Knowing Where We are Going

- Vision: A clear and compelling picture of what the business aspires to become in the future. It serves as a guide for choosing current and future courses of action.

- Long-term Goals: Specific, measurable, achievable, relevant, and time-bound (SMART) goals that outline the desired outcomes over an extended period.

- Milestones: Intermediate targets that mark progress towards the long-term goals.

3. Understanding Why We are Doing This

- Purpose: The fundamental reason for the business’ existence beyond making a profit. It encompasses the broader impact the business aims to have on its community.

- Motivation: The driving force behind the business’ actions and strategies. This includes the values and principles that guide decision-making, as well as behavior.

- Stakeholder Alignment: Ensuring that the goals and activities of the business align with the interests and needs of its stakeholders: guests, employees, investors, and the community.

4. How We are Going to Get There

- Strategy: The overarching plan that outlines how the business will achieve its vision and long-term goals. It includes the allocation of resources and the selection of strategic initiatives.

- Tactics: The specific actions and steps that will be taken to implement the strategy. This involves detailed planning, delegation, resources, and execution.

- Performance Metrics: The criteria and tools used to measure progress and success. Key Performance Indicators (KPIs) and other metrics help track the effectiveness of strategies and tactics.

- Continuous Improvement: The process of regularly reviewing and refining strategies and tactics based on performance data and changing circumstances.

Strategic clarity is essential for the cohesive and effective functionality of your bar, restaurant, or hotel business. This leadership approach ensures that all members understand and are aligned with the business’ identity, direction, purpose, and methods.

By achieving strategic clarity, organizations can navigate challenges, seize opportunities, and build upon sustainable long-term success. What we have found over the years that attributes to long-term clarity and success is a series of playbooks.

Understanding Plans and Playbooks

Let’s first dive into the critical distinction between a plan and a playbook, and why this matters for your bar, restaurant, or hotel. Understanding and utilizing both can significantly impact your business’ ability to start strong, stabilize effectively, and ultimately position you to scale successfully.

A traditional business plan, as you may know it, is a document that outlines your goals, and the steps you will take to achieve them. It’s often the number one consideration to secure funding and to set strategic direction.

However, it is, more often than not, missing plenty of crucial information, strategies, and guidance that end up planting a false sense of security.

A playbook, on the other hand, is a more comprehensive guide filled with detailed processes, best practices, and adaptable strategies tailored to your specific operations. Within this dynamic industry, you need more than a standard business plan if you want to be successful.

In fact, you should have eight different playbooks in place to position yourself within the top echelon of this industry.

The Power of Playbooks in Hospitality

While plans are often static or rigid (and often forgotten about shortly after they’re written), playbooks are designed to be flexible and adaptable.

Playbooks provide a step-by-step guide, ensure consistency and efficiency, and offer adaptable strategies and best practices to start, manage, and grow effectively.

Playbooks go into more granular details, and provide actionable steps. In this way, they’re notably different from a singular business plan.

The Eight Playbooks

No matter if you are operating a coffee shop, bar, restaurant or hotel (or any other concept within the hospitality industry), the following eight playbooks should be looked at as non-negotiables.

- Feasibility Study/Playbook: The foundational guide for assessing the viability of your hospitality business idea. It involves a comprehensive analysis of the market, competitive landscape, financial projections, and operational requirements. This playbook helps you determine whether your concept is realistic and profitable before committing significant resources.

- Concept Playbook: Focuses on refining your hospitality business idea into a clear and compelling concept. This playbook guides you through creating a unique value proposition, defining your target market, and outlining the core elements of your business, including service style, interior design, and internal programming.

- Prototype Playbook: A step-by-step guide to developing a tangible representation of your hospitality concept. This playbook helps you create a prototype that can be tested and refined before a full-scale launch. This playbook covers design specifications, operational workflows, fixtures/furniture/equipment, and detailed budgets.

- Brand Strategy & Identity Playbook: Defines the strategic approach to building and maintaining a strong brand. This playbook covers the creation of your brand identity, messaging, and positioning to ensure consistent and impactful brand communication. It involves color psychology, core values, mission statements, brand experiences, and more.

- Marketing Playbook: Outlines the strategies and tactics to attract, build, and retain your target guests. This playbook provides a roadmap for creating and executing effective marketing campaigns across various channels. It provides a step-by-step guide on content, social media management, database building, email marketing, partnerships, and community activations, along with detailed guest journey maps.

- Tech-stack Playbook: Provides guidance on selecting and implementing the correct technology solutions to enhance your hospitality operations. This playbook ensures that your technology infrastructure supports your business goals and improves efficiency. This playbook identifies technology gaps, software solutions, hardware requirements, and integration plans, plus training and support on technology.

- Financial Playbook: A comprehensive guide to manage your hospitality business’ finances. This playbook covers budgeting, financial forecasting, accounting practices, and financial performance analysis. It should highlight financial contingency plans, mock labor schedules, daily/weekly/monthly/seasonal traffic reports that align with the business, and financial objectives.

- Operational Playbook (a.k.a. Business Plan): Outlines the day-to-day operations in great detail, along with long-term strategies. This playbook ensures that all aspects of your operations are well-coordinated and aligned with your overall business goals, and the other seven playbooks. It should highlight standard operating procedures, labor plans, supply chain management, guest services, and measurable operational metrics.

You’ll notice there are seven other playbooks written before the business plan. Far too often, this is where people start. Without the other seven playbooks, it will be nearly impossible to craft a winning playbook for your day-to-day operations.

When Should You Use Playbooks

- To Start: These eight playbooks are crucial to craft your success story right from the beginning. Build the foundations before signing a lease or purchasing a property.

- To Stabilize: If you’re currently underperforming (profit margins under 12 percent for bars and restaurants, and under 15 percent for hotels), use playbooks to generate impactful results.

- To Scale: These playbooks will help ensure that both your first location—and the next location—are prepared for consistent operations without diminishing your brand equity.

Strategic planning within detailed playbooks is essential for your hospitality business’ success.

Regardless of your current position, evaluate your use of business plans, and consider developing comprehensive playbooks instead. Make the time and commitment to achieving true clarity in your business, and position yourself to be on the correct side of this industry’s statistics.

AI image generator: DALL-E