Forward Progress: Trends by Venue Type

by David Klemt

One notable difficulty with considering new trends is that they’re not all necessarily a universal fit for all venue types.

For example, what may work well in an upscale restaurant perhaps won’t perform as well in a sports bar. Pursuing a trend that isn’t a good fit, obviously.

As any operator with experience knows, chasing fads and trends just to chase them can be costly. Doing so costs money (inventory, training, labor hours) and time deserving of better allocation.

However, failing to embrace any trends can also be costly. Watching a lucrative trend pass by can cost an operator guest engagement, perception, and traffic.

Take, for instance, the success of White Claw. Plenty of operators and consumers scoffed at the hard seltzer category as a whole at first.

Then, some people decided it was a drink category “for women.” As it exploded in popularity, hard seltzers proved immensely popular with men.

Basically, it’s an incredibly strong beverage alcohol category that resonates with a wide range of consumers. On some menus, hard seltzers are listed alongside beers.

So, hard seltzer, led largely by White Claw, showed itself to be a worthwhile trend to adopt.

Clearly, however, hard seltzer doesn’t resonate with all guests on all occasions in all types of hospitality venue types. For instance, generally speaking, a bucket of White Claws likely to be a top seller in a high-end restaurant specializing in seven- to nine-course meals.

Drink Trends by Venue

During Bar & Restaurant Expo in March of this year, Amanda Torgerson of Datassential presented 2022 drink trends operators should know.

One trend has essentially proliferated the industry. Really, it’s likely wise for us to all view this trend—hard seltzer—as mainstream now.

In the context of Torgerson’s presentation, Datassential is saying that hard seltzers are here to stay.

Among other trends, Torgerson shared Datassential’s data-backed view of drink trends segmented by venue category.

While every venue is unique and not every trend will work for every bar or restaurant in a given category, the results are no less intriguing.

Pubs: Dry-hopped beers, pastry stouts, and hard or spiked coffee.

Sports Bars: Mini-beers, hard seltzer, and reusable growlers.

Casual Bars: Seltzers with unique flavors, hard tea, hard lemonade, and drinks featuring local ingredients.

Upscale Bars: Negroni, wine-barrel-aged spirits, and flaming cocktails.

Nightclubs: Hard seltzers served with spirits, cocktails and punch bowls served with dry ice, and flaming cocktails.

Casual Restaurants: Wine cocktails, elevated brunch cocktails, and tea-based alcohol beverages.

Upscale Restaurants: Flaming cocktails (smoked may be better), all-natural wines, and made-to-order cocktail cart presentations.

Hotels, Resorts and Casinos: Made-to-order cocktail carts, alcohol vending machines, and drinks made with cold-pressed juices.

Interestingly, a few of the above trends identified by Datassential appear in multiple venue types.

The main things for an operator to keep in mind is what will resonate with their guests and what’s authentic to their brand. When it comes to trends, one size doesn’t fit all and an individual venue’s mileage will vary.

However, the above list should at least show operators what Datassential sees resonating with guests in an array of venues.

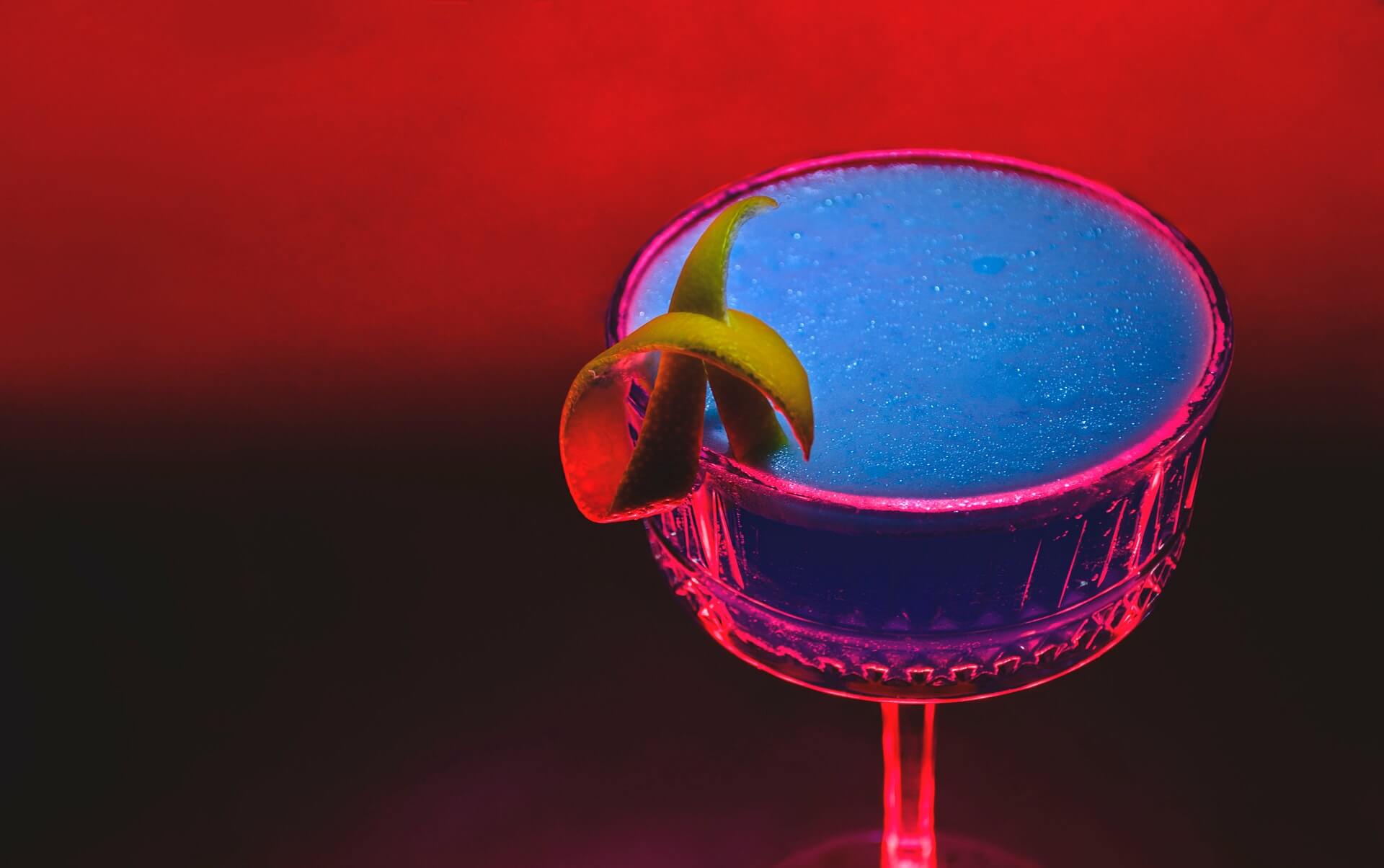

Image: Ozge Karabal on Pexels