The Shrinking Globe: 2024 European Food Trends

by David Klemt

It should come as no surprise that 2024 F&B trends are similar throughout Europe and the UK to those taking hold in North America.

Why do I refer to Europe and the UK separately? I’m aware that the UK is part of Europe. Regionally, one can think of the nation as northwestern Europe.

However, while geographers consider the UK part of Europe, many citizens of the UK don’t see things that simply. So, that’s why I mention the continent and nation separately.

With that out of the way: 2024 F&B trends. People like to say that the world is getting “smaller,” that the devices in our hands are making everything more accessible. That certainly seems to be the case with food and drink.

What you’ll likely notice is that the trends below follow what experts predict for North America rather closely. As David Allison says, people have far more in common with one another than they have differences.

The Consumer

Plants

I think it’s fair to say that plant-based diet mockery is defined by two characteristics.

One, people seem to aim their ridicule toward Americans. And two, it’s cliché at this point.

Much of the world already embraces plant-based diets. That doesn’t mean they’re only either vegetarian or vegan, either.

Estimates for how much of the world consists of flexitarians can reach over 40 percent. This particular diet limits or restricts the intake of animal-based foods. However, it’s not like veganism; flexitarians do consume some animal products. One can say that it’s a very individual diet. In fact, I doubt many flexitarians actually refer to themselves with that label.

Interestingly, though, plant-based brands must innovate if they’re going to succeed with consumers in Europe and the UK.

Hey, what do you know? That’s how it is in North America.

Now that plant-based protein alternatives are here to stay, people want to see innovative analogs.

They’ve seen nuggets and fingers. Burgers and patties aren’t anything new. People want plant-based counterparts for everything: seafood, steak, pork, etc.

Health & Wellness

Here’s a frighteningly hot take: People in Europe and the UK are concerned with their health. Shocking!

For the past few years, much has been made about North Americans and their “renewed” focus on their health and wellness. This is, of course, for obvious reasons.

Well, we can say the same about Europeans and Britons.

Generally speaking, people are trying to reduce their intake of processed foods. This ties to the section above in that many plant-based foods are highly processed. Brands will need to address this to achieve long-term success.

Along with avoiding processed foods, consumers in Europe and the UK are seeking out dishes that are higher in protein and fiber.

Across generations and Europe, people realize that a healthy diet is the top factor in feeling healthier.

The Operator

Happy Balance

Europeans and Britons have centuries upon centuries of history and tradition to contend with throughout their countries.

In some markets, this can lead to conflict or the misconception that operators can’t innovate.

This is, of course, an outdated way of thinking.

Whether operating in the UK or Europe, operators are embracing tech and finding ways to honor tradition while experimenting with the modern.

From the back of the house to the front, chefs and bartenders are drawing inspiration from culinary traditions. However, they’re also getting creative to put their own spins on the menu.

Perhaps more importantly, the guests they’re serving want to try these innovations.

From consumer-facing tech that enhances their visits to creative menu items that find inspiration from around the world, today’s guest is hungry and thirsty for what’s new. This is true regardless of how old and traditional a location may be.

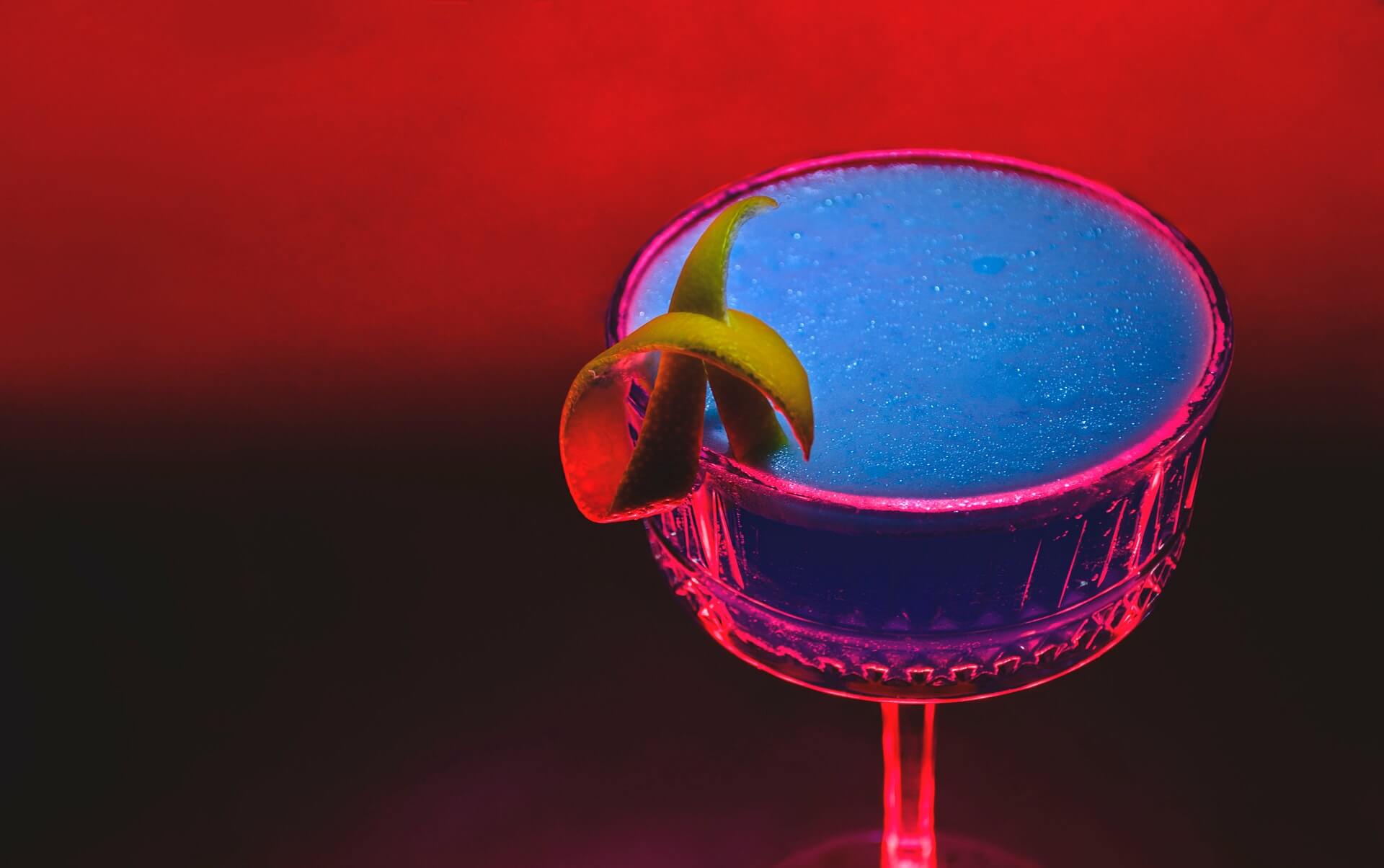

Color

Just a few months ago, Frankfurt, Germany, played host to Food Ingredients Europe 2023.

One of the takeaways from last year’s show that stood out to me is the interest in color.

According to one market development specialist, it appears that Gen Z in Europe and the UK are over boring, bland shades. Instead, they want to be colorful.

From interior and physical menu design to food and drink items, European and British operators can deliver on that desire.

Of course, taking one’s concept in a more colorful direction necessitates knowing one’s guests. So, this is where exceptional service despite concept or category and robust tech platforms come into play.

If bold color is authentic to a concept and resonates with the guests, it could be time to reach out to an interior designer.

Speaking of reaching out, if you’re in Europe or the UK, have a concept you want to open or are already open and need some assistance, KRG Hospitality is excited to announce that we’re entering markets within both regions. Please contact us—we’re here to help.

Image: Ella Olsson on Unsplash