The Power of an ImpactMAP™

by Doug Radkey

Let’s be honest, the line between success and failure often hinges on the ability to act decisively and act with purpose.

In this article, we’re going to explore two areas of your hospitality business that are under your control: creating a plan, and taking action.

Understanding the Risk of Inaction

The concept surrounding the Risk of Inaction—arguably a new form of ROI—captures the potential losses businesses face when they fail to take strategic actions.

Inaction in the hospitality industry can manifest in various harmful ways. Inaction can also stem from multiple sources: fear of change, lack of resources, or simply underestimating the competition.

Regardless of the manifestation or cause, the consequences are usually the same: stagnation, decline, and, ultimately, a shuttered business.

Let’s put this into context by taking a look at a sample of both a restaurant and a hotel business.

Failure to Innovate

If a restaurant does not act to continuously re-engineer its menu, it risks diminishing profits, providing a low-level guest experience, and mismanaging inventory. Without regular strategic updates, the menu may fail to reflect current culinary trends and guest preferences, which can lead to a decrease in interest and satisfaction.

Additionally, sticking with a static menu can prevent the restaurant from optimizing ingredient use, productivity, and cost-efficiency.

At the end of the day, this lack of adaptation and innovation will result in diminishing sales and profitability, making it difficult for the restaurant to sustain its operations.

Failure to Update Systems

If a hotel on the other hand decides to not use a modern and fully integrated Property Management System (PMS), it risks operating inefficiently and falling behind in today’s technology-driven hospitality environment.

A non-existent, outdated, or fragmented PMS can lead to significant operational issues, such as slow check-in and check-out processes, errors in room availability and booking management, and ineffective communication between different departments. That’s just to name a few crucial issues.

This inefficiency can impact guest experiences negatively, leading to dissatisfaction and potentially harming the hotel’s reputation.

Furthermore, without a modern PMS, a hotel may struggle with data management, limiting its ability to effectively analyze performance metrics, forecast demand, and implement dynamic pricing strategies. These disadvantages will result in lost revenue and reduced competitiveness in a space where guest expectations and operational efficiency are increasingly driven by technological advancements.

In each example above, the risk of inaction leads to missed opportunities and underperformance.

The Power of an ImpactMAP™

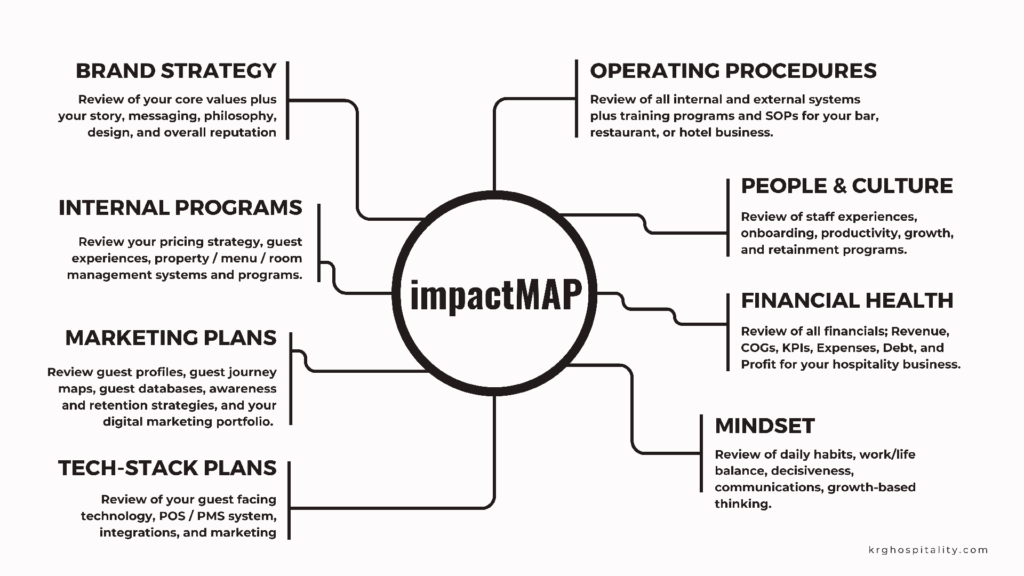

To combat the risks associated with inaction, your hospitality business can benefit significantly from developing an ImpactMAP™.

This strategic tool can help you identify where you currently stand, define where you want to go, and outline the steps required to get there, thereby helping you create not only strategic clarity, but drive and accountability.

The Assessment

To create an ImpactMAP™ and to take action immediately, you need to first assess your operations.

An assessment of your hospitality business is a comprehensive evaluation process aimed at analyzing various aspects of your business to identify strengths, weaknesses, and areas for improvement or opportunity. The goal is to gather actionable insights that can help optimize operations, enhance guest experiences, and massively improve your profitability.

The assessment should involve on-site observations, staff interviews, and a deep dive into the following eight categories, culminating in a detailed report that provides recommendations and a strategic plan for future growth and sustainability.

For each of the eight categories, consider a 3x matrix with three responses to the following questions:

- Where are we now?

- Where do we want to go?

- What resources do we need?

- What’s holding us back?

Then, create a SMART (Specific, Measurable, Achievable, Relevant, Timely) goal for each response in your “Where We Want to Go” list.

What are the eight assessment categories?

1. Brand Strategy

Assessment: Review your core values, story, messaging, philosophy, design, and reputation.

Opportunity: Enhance brand alignment across all touchpoints to ensure consistency while refining your brand messaging to better connect with targeted guest profiles.

2. Internal Programming

Assessment: Review your pricing strategy, guest experiences, property / menu / room management systems and programs.

Opportunity: Optimize your offerings based on guest preference data and a profitability analysis, along with potential upgrades to your amenities to enhance guest satisfaction and to compete with today’s market standards. In summary, implement efficiencies to improve guest experiences and operational workflow with a focus on your internal programming.

3. Marketing Plans

Assessment: Review guest profiles, guest journey maps, guest databases, awareness and retention strategies, and your digital marketing portfolio.

Opportunity: Integrate advanced digital marketing techniques to increase reach and engagement while developing targeted promotions and partnerships, and by leveraging data analytics to tailor marketing efforts more precisely to guest behaviors and trends.

4. Tech-Stack Plans

Assessment: Review guest facing technology, POS / PMS system, integrations, and marketing.

Opportunity: Identify current technology gaps and plan for a strategic integration of systems that enhance guest experiences while streamlining operations.

5. Standard Operating Procedures

Assessment: Review of all internal and external systems, plus training programs and SOPs.

Opportunity: Ensuring that all staff are clear on their roles and responsibilities, which enhances overall service quality through the development of standardized procedures that ensure consistency and efficiency across the business. Implement feedback systems to continually refine and improve SOPs based on real-time challenges and successes.

6. People and Culture

Assessment: Review of staff experiences, onboarding, productivity, growth, and retainment.

Opportunity: Strengthen employee engagement through improved communication and support systems. Foster a culture of innovation and openness in which employees feel valued and motivated. Develop leadership from within to enhance management effectiveness and succession planning.

7. Financial Health

Assessment: Review of all financials, including Revenue, COGs, KPIs, Expenses, Debt, and Profit.

Opportunity: Identify cost-saving opportunities without compromising service quality. Explore new revenue streams that align with your brand values and market opportunities. Implement more rigorous financial tracking and forecasting tools (such as technology) to better predict financial trends and react proactively.

8. Mindset

Assessment: Daily habits, work / life balance, decisiveness, communications, and growth-based thinking.

Opportunity: Develop a mindset of continuous improvement among all staff levels (starting with yourself) to foster an environment of excellence. Cultivate resilience by planning for crisis management and business continuity. Promote a guest-centric approach, aligning all business decisions with guest satisfaction and personal development outcomes.

Creating the ImpactMAP™

By following the above 3x strategy for each category, you will have created 24 SMART objectives that will be the foundation of your ImpactMAP™ to move your business forward over the next one to six to 12 months.

Importance of SMART Objectives

What does SMART mean and how does it work?

- Specific, Clarity, and Focus: SMART objectives provide clear and concise goals that everyone in your business can understand and rally behind. This clarity helps to focus efforts and resources on what’s most important.

- Measurability and Tracking: By setting measurable goals, your business can track progress and make data-driven decisions. This measurability allows for adjustments to be made in strategies or tactics to ensure the objectives are met.

- Achievability: Goals that are achievable motivate staff. Setting impossible goals can lead to frustration and disengagement, whereas achievable objectives encourage team effort and commitment.

- Relevance: Ensuring that each objective is relevant to the broader business goals ensures that every effort made contributes to the overall success of your brand.

- Timeliness: Incorporating a timeframe provides urgency, a deadline, and accountability, which can help prioritize daily tasks and long-term plans.

However, you shouldn’t try to accomplish all 24 objectives at the same time. Once you’ve set your 24 impactful objectives, prioritizing them is crucial to stabilize your hospitality business and aim for scalable growth.

Best Practices for Prioritizing Objectives

- Assess Business Needs: Start by conducting that thorough assessment of your business to identify key areas that need improvement.

- Impact Analysis: Evaluate the potential impact of each objective. Prioritize objectives that offer the greatest benefits in terms of guest satisfaction, revenue growth, and operational efficiency.

- Resource Availability: Consider the resources available, including budget, people, and technology. Prioritize objectives that align with current resources or where adjustments can be made to accommodate necessary changes.

- Quick Wins: Identify objectives that can be achieved quickly and with minimal disruption to your ongoing operations. These quick wins can boost morale and provide visible improvements that justify further investments in other areas.

- Strategic Importance: Some objectives, while not providing immediate benefits, are crucial for long-term success. Prioritize these based on their strategic importance to the business’s future.

- Stakeholder Input: Engage with various stakeholders, including management, staff, and guests, to gain insights into which objectives they feel are most critical. This can help in aligning the goals with the needs and expectations of those most affected by the changes.

- Balanced Scorecard: Use a balanced scorecard approach to ensure that objectives across different areas such as guest services, internal processes, financial performance, and learning and growth are all being addressed.

- Iterative Review: Regularly review the priorities as situations and business dynamics evolve. What may be a priority today might change based on market conditions or internal business changes over the next three to six months.

Once you have your objectives prioritized, it’s time to assign or delegate them as needed and have those assignees (including yourself) take ownership of the objectives with their signature to add another level of accountability.

Implementing the ImpactMAP™

Before starting, ask yourself one final question: What will happen if we don’t take action?

Be detailed and mindful of what the short-term and long-term consequences might be if you don’t act.

Effective implementation of an ImpactMAP™ requires knowledge of these consequences, along with a commitment from all levels of your business. It starts with comprehensive training sessions followed by regular review meetings, which are both essential to assess progress, address challenges, and refine strategies as needed.

Take a SMART-ER approach, which is where you Evaluate and Re-adjust the SMART objectives halfway through the timeline you’ve set.

Conclusion

Risk of inaction is a silent threat that can undermine any business, particularly in this dynamic industry.

Adopting an ImpactMAP™ and making a commitment to take massive action allows you to manage your operations proactively, adapt to changing market conditions, and set a course for sustainable success.

This strategic approach not only mitigates risks but also empowers your hospitality business to thrive in a competitive landscape—but it starts with you and your mindset toward taking action.

Image: KRG Hospitality