Pumpkin Spice Season Descends Upon Us

by David Klemt

Once again, the unstoppable march of the spooky season is upon us, bringing with it a frightening assortment of pumpkin spice items and expectations.

In the blink of an eye, hordes will descend on your restaurant or bar. “Pumpkin spiiiiiice,” they’ll croak.

Okay, so that’s overly dramatic. For the most part, pumpkin spice season is anything but scary. And really, very few people will transform into singularly focused pumpkin spice zombies.

However, fall is nearly here. So, you do need to finalize your fall/autumn menu. Beginning in September, that really does mean considering offering at least one pumpkin spice LTO item.

Interestingly, though, pumpkin spice may not deserve its perception as the flavor of fall. According to Datassential, there are ten flavors that index high enough to give pumpkin spice a challenge for the fall throne.

What are they? Well, it just so happens that Datassential has those answers, along with a bit of useful advice.

Lord of the LTO

Recently, Datassential released “Food Industry Trend Report: 2022 Pumpkin Spice Season.” As the research firm points out, pumpkin spice seems to be encroaching on summer more each year.

How far away are we, I wonder, from pumpkin spice claiming summer for itself? Will we be subjected to pumpkin spice dry rubs at summer barbecues? Is some intrepid operator going to create a pumpkin spice lemonade?

Those terrifying questons aside, pumpkin spice season coming earlier means more opportunities to benefit from LTOs. Just as it seems that pumpkin spice is descending upon us earlier and earlier, it also seems to dominate the LTO space.

In fact, per Datassential research, major chains executed 174 pumpkin spice LTOs. Now, that’s still with a five-percent drop in menuing for pumpkin space over the past 12 months. Further, that number doesn’t include small, regional chains and independents who also launched pumpkin spice LTOs.

Of course, there are also other fall flavors that deserve a place on operators’ menus. And they’re perfectly cromulent as LTO drivers.

Fall Flavor Favorites

To inspire operators to create LTOs that entice consumers this fall, Datassential has identitied ten flavors on which to focus. Helpfully, they separate them into two main categories.

Top five sweet fall flavors:

- Vietnamese cinnamon

- Spicy ginger

- Allspice

- Eggnog

- Pumpkin pie

Top five savory flavors:

- Coconut milk

- “Oktoberfest”

- Mustard cream

- Turkey gravy

- Cranberry sauce

Personally, I can see operators and their teams needing to get creative to leverage mustard cream and turkey gravy. Interestingly, Datassential suggests a few flavors not on either list above.

According to their report, Datassential expects apple and blood orange to be popular for LTOs this year. According to the firm, apple was popular last year. When it comes to blood orange, Datassential says 38 percent of consumers like or love the flavor.

Whichever flavors you choose, Datassential has the following advice, which we co-sign: Ensure your LTOs are fresh; make sure they’re easy and quick to make; and don’t discount them. In fact, you should create premium LTOs that come with a premium price.

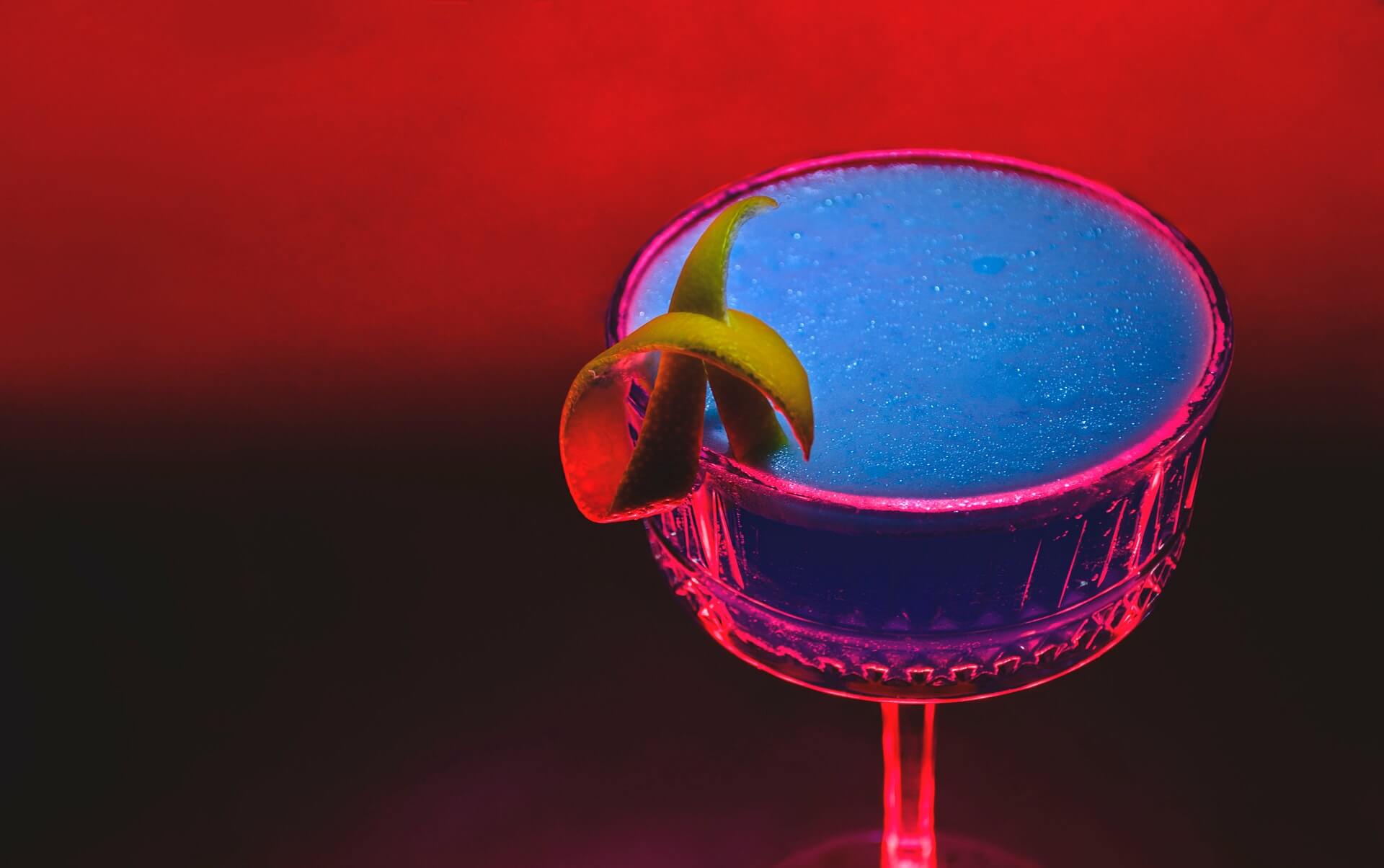

Image: Colton Sturgeon on Unsplash