EHI and Danny Meyer Invest in SevenRooms

by David Klemt

SevenRooms is showing no signs of resting on their laurels, announcing a major new investor: Enlightened Hospitality Investments.

EHI, a private-equity fund, traces its launch back to 2016. The fund, launched by and affiliated with Union Square Hospitality Group, typically makes investments in the $10-25 million range. Generally speaking, EHI makes non-control investments.

As you’re likely well aware, USHG’s founder and executive chairman is none other than restaurateur Danny Meyer. The Shake Shack chairman is also the managing partner of EHI.

Investment in SevenRooms by EHI—and by extension Danny Meyer—is huge news. Meyer now joins other high-profile chef and restaurateur investors in SevenRooms:

- Chef José Andrés

- Chef Thomas Keller

- Jeremy King

- Chef Michael Mina

- Chef Wolfgang Puck

“At EHI, we always pay close attention to transformative tech that advances high touch,” says Meyer. “Far more than a reservations platform, SevenRooms provides abundant tools to create highly customized guest experiences and equips both restaurant and hotel teams to do what they do best—deliver truly memorable hospitality.”

Continual Growth

Since 2011, SevenRooms has pursued growth while serving the hospitality industry.

Whether in terms of innovation, partnerships, appointing the right people to key roles, or attracting investors, the platform is constantly strategizing to ensure its longevity.

Just look at what the company has achieved over 24 months:

- March 2021: SevenRooms appoints Pamela Martinez as the company’s chief financial officer.

- September 2021: SevenRooms announces a multi-year partnership with TheFork. The partnership is big news for operators throughout Europe and Australia. Further, the partnership illustrates how the company is pursuing global growth.

- October of 2021: The company forms a partnership with Olo. This ensures clients who also use Olo are able to capture data from a key group: off-premise customers. That data creates profiles for such customers automatically. That means operators can learn more about—and effectively market to—customers who engage with them via online orders.

- December 2021: SevenRooms and ThinkFoodGroup—the hospitality company behind Chef José Andrés’ portfolio of restaurants—make their partnership public. Interestingly, this partnership also includes ThinkFoodGroup joining SevenRooms in an advisory role.

- January 2022: The platform announces the hiring of a chief revenue officer, Brent-Stig Kraus.

- December 2022: SevenRooms enters into a partnership with Competitive Social Ventures.

- January 2023: The company announces the appointment of their first-ever chief marketing officer.

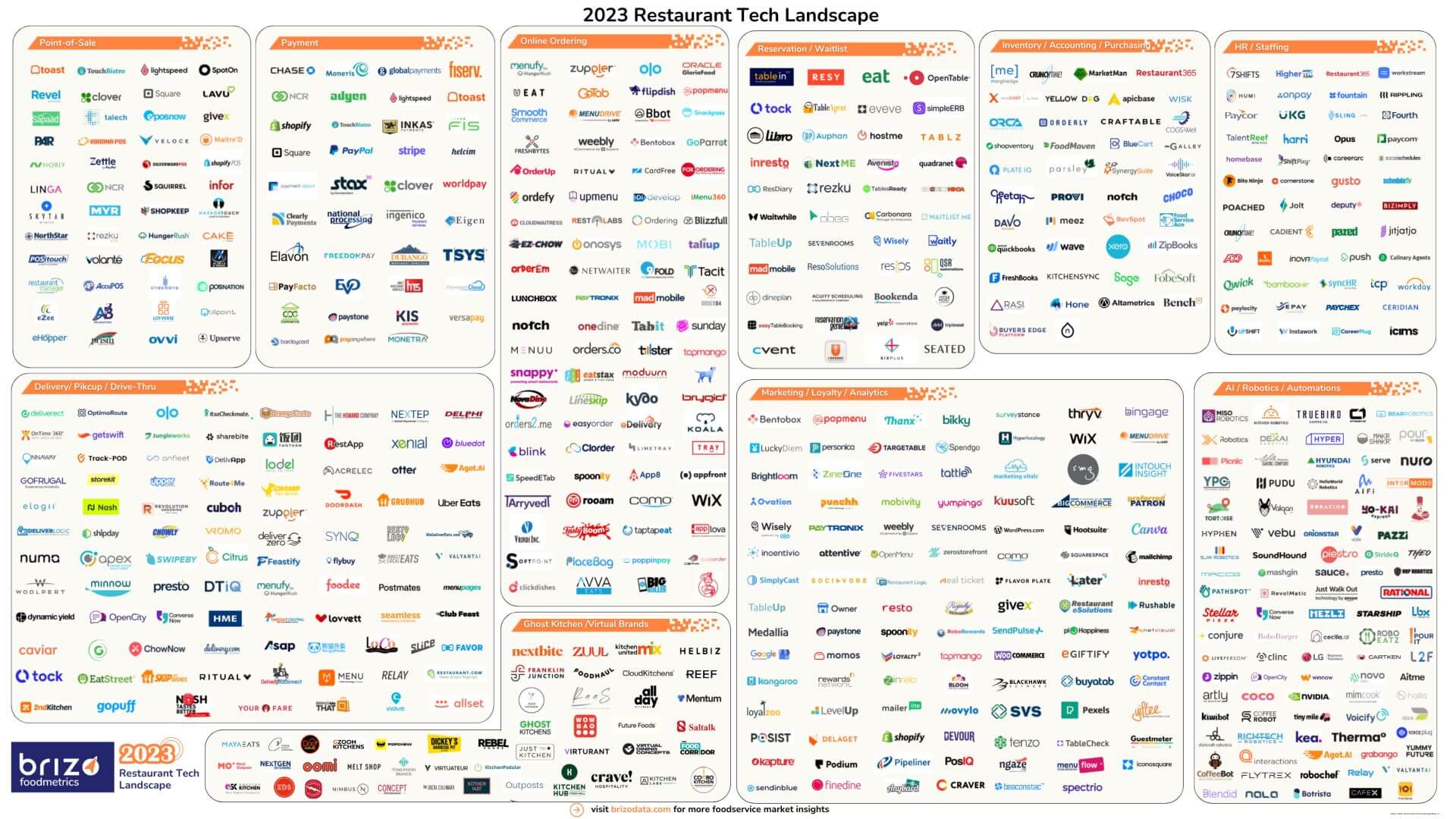

As our industry rapidly attracts tech platforms and innovations, it can be difficult to know which companies are here to stay.

The growth of SevenRooms shows stability and longevity. Those are two key factors that should inform operator decisions when considering the tech stack.

Image: SevenRooms