Months Pass, RRF Replenishment Remains Uncertain

by David Klemt

If you’re wondering if the RRF Replenishment Act of 2021 or ENTREE Acts are making progress, you’re not alone.

Unfortunately, it appears far too many politicians on all sides are focusing on anything but our industry.

Indeed, it’s apparently more important that they score political “points” for sniping at each other on social media; engage in hyperbole and histrionics; and overall engage in brinksmanship instead of doing anything meaningful for their constituents.

Meanwhile, the industry has lost more than $300 billion in revenue over 19 months. Additionally, we’re short at least one million jobs.

So, it’s not hyperbolic to state this: It’s no longer time for Congress to act, time has very much run out.

It’s up for owners and operators, their teams, and their teams’ families.

Replenish RRF Act

As people familiar with the Restaurant Revitalization Fund will recall, the fund launched with $28.6 billion. Obviously, that was nowhere near enough funding to meet the demand for grants.

The National Restaurant Association estimates that 177,000 grant applicants are still waiting for assistance. Those applications total more than $43 billion.

Essentially, $60 billion would be printed to replenish the RRF. That’s according to the language in the RRF Replenishment Act bill.

In June, Sens. Kyrsten Sinema (D-AZ) and Roger Wicker (R-MS), and Reps. Earl Blumenauer (D-PA) and Brian Fitzpatrick (R-PA) introduced the bill.

It’s now the middle of October.

ENTREE Act

Toward the end of July, Rep. Blaine Luetkemeyer (R-MO) introduced an alternative bill.

A ranking member of the House Committee on Small Business, Rep. Luetkemeyer proposed the Entrepreneurs Need Timely Replenishment for Eating Establishments Act on July 20.

Again, that was in July and it’s now October 25.

Known as the ENTREE Act (acronyms are fun, eh?), this bill wouldn’t just create $60 billion out of thin air.

Instead, per the text of the bill, the ENTREE Act would use unspent funds from the American Rescue Plan and Economic Injury Disaster Loans.

Now What?

In early August, there was an attempt made to replenish the RRF with $48 billion of emergency funding.

Sen. Ben Cardin (D-MD), along with a bipartisan group of senators, sought unanimous consent to authorize the funds.

Unfortunately, Sen. Rand Paul (R-KY) objected to the unanimous consent motion. The measure was blocked due to Sen. Paul’s objection and the RRF didn’t receive any emergency funds.

So, now what? In August, political insiders expressed their opinion that the ENTREE Act wasn’t likely to be passed.

Meanwhile, the RRF Replenishment Act hasn’t made significant progress since it was first introduced in June.

Most recently, members of the Independent Restaurant Coalition held a press conference with Rep. Blumenauer and Rep. Dean Phillips (D-MN). During the press conference, it was pointed out that Congress was voting on infrastructure bills that didn’t contain the RRF Replenishment or ENTREE Acts.

The most that can be said currently about any “progress” is that House Speaker Nancy Pelosi has made a promise that relief for the industry is coming, somehow, during some unknown timeframe.

Great. In the meantime, you, your family members, your friends, and your guests can contact their reps to put more pressure on them to replenish the RRF. You can also click here for more ideas from the IRC on how to get the message across that our representatives need to act now.

Perhaps reminders that every House seat and 34 Senate seats are up for re-election next year will help spur some action.

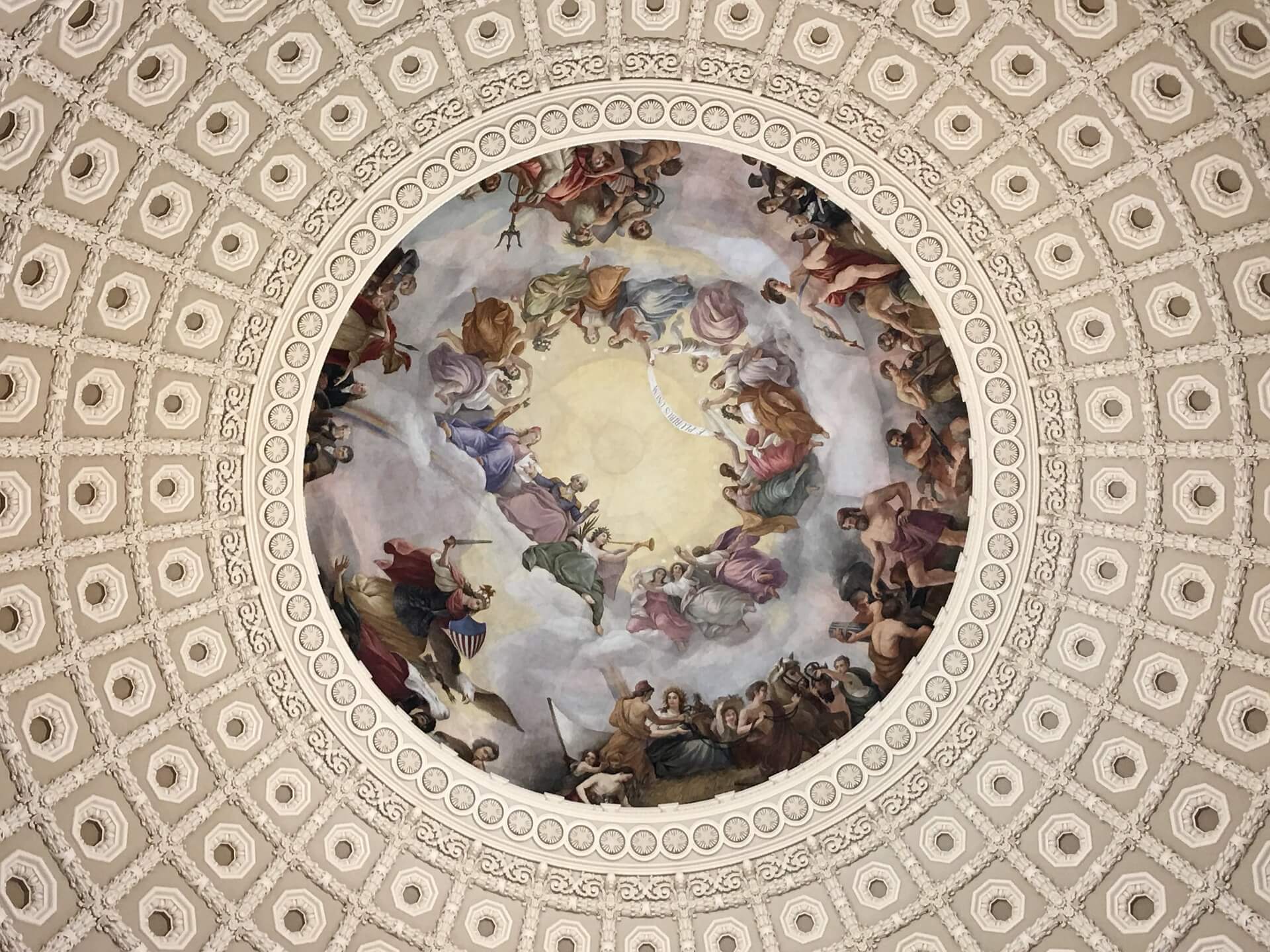

Image: Eduin Escobar from Pixabay