Addressing Employee Theft

by David Klemt

Recent posts about employee theft in the hospitality industry throughout Canada and the US have the KRG Hospitality team talking.

Indeed, the statistics are startling. For instance, there’s the claim that a staggering 75 percent of employees admit to stealing from their employers “at least once.”

A few years back, the Retail Council of Canada reported that while “customers” stole $175 on average, employees stole $2,500 before being caught.

Then there’s the incredible economic impact. Multiple sources claim employee theft in the US costs businesses $50 billion annually. In Canada, theft costs businesses more than $1 billion per year. Both numbers are shocking.

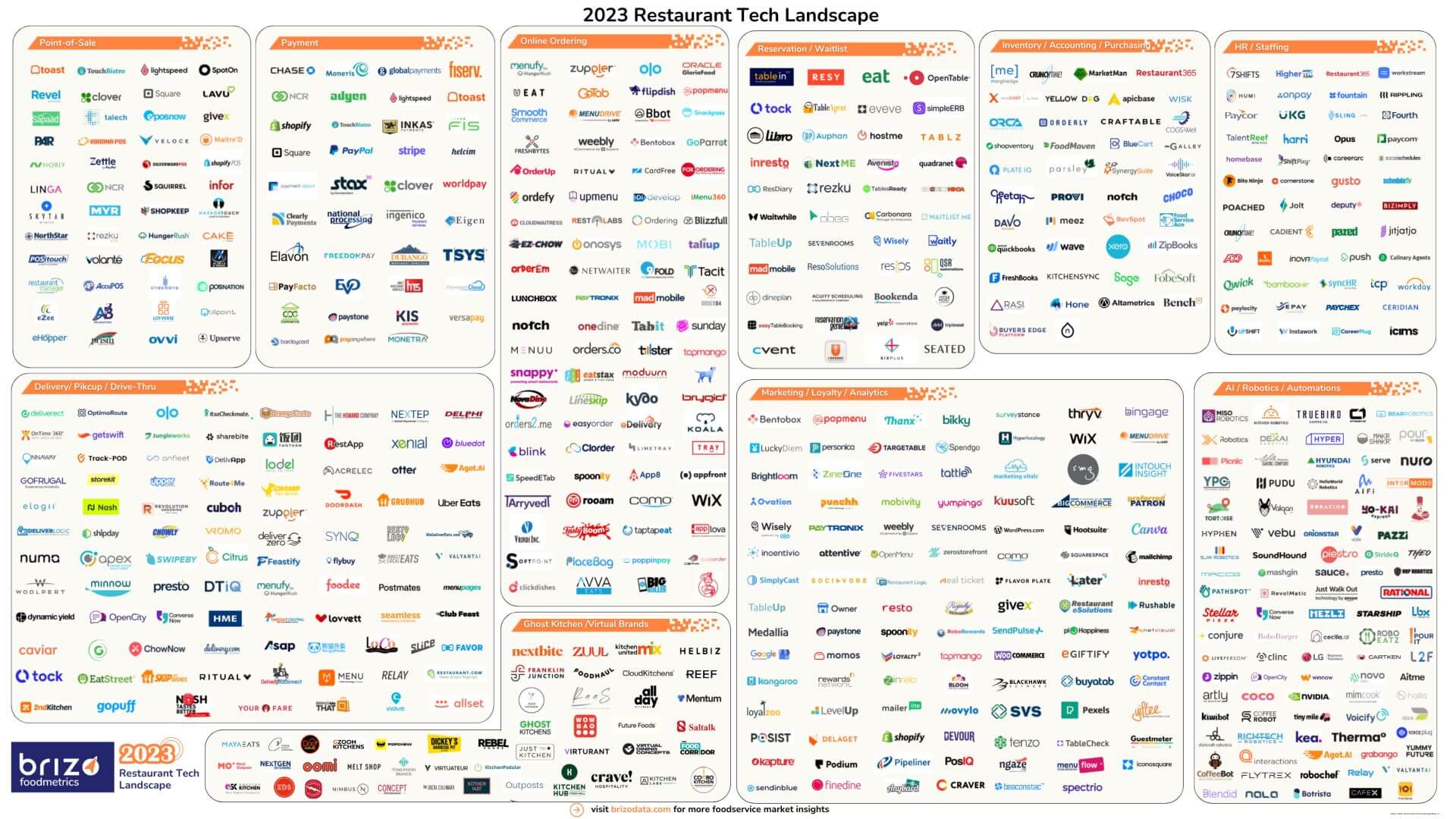

Looking at US restaurants specifically, the number ranges from $3 billion to $6 billion in losses due to employee theft. According to Business.com, employee theft affects four percent of a restaurant’s sales and accounts for 75 percent of shortages in inventory.

At this point, you’re probably Googling security cameras. But hold on for a moment.

Disclaimer

Before proceeding, know this: I’m going to make a few points that will seem like victim blaming. In part, this perception will be the result of my addressing recruiting, hiring, onboarding, training, the leadership team, and workplace culture.

Let me be clear: I’m not excusing employee theft. I don’t think there’s any justification for it.

Despite what a (hopefully) small number of loud voices claim on various social media platforms and forums, I don’t think it’s acceptable to steal from a corporation or business owner. No, theft isn’t a justifiable response to feeling slighted by ownership or leadership. And no, it’s not “okay” because a company generates “so much” revenue, has insurance, and can “write it off.”

With that out of the way, let’s proceed.

People are Going to Steal

Here’s one immutable fact: You’re going to hire someone who’s going to steal from your business.

Is your business up and running and serving guests? You employ someone right now who has either stolen from you already or is going to steal.

So, you can run your business under a cloud of suspicion and distrust. Or, you can improve your odds of reducing theft and ferreting out thieves before they do too much damage.

Again, you can install security cameras and place them above each POS terminal and every cash drawer. You can ensure you have clear, cutting-edge CCTV coverage of the entire bar and dining areas. Walk-ins and storage areas can have clear, high-resolution camera coverage.

Honestly, you should have that type of coverage. That type of security can improve employee and guest safety, and your insurance carrier will likely be happy about it.

But you don’t need to impose an atmosphere of suspicion, fear, and intimidation along with the cameras. If you were an employee, would you want to work somewhere that makes it clear you’re always under suspicion? Would you want to work alongside a leadership team whose default setting is that all employees are thieves unworthy of trust?

Workplace Culture

You’re never going to have a theft-free business, period. That’s another reason to not “lead” with fear, anger, and suspicion.

Truly, all that style of leadership will do is drive good, honest employees out. So, the approach should be attracting honest workers. You build a strong, trustworthy team through respect and empowerment.

Yes, there will be employees who take advantage of that respect. They were going to behave that way and steal or otherwise disrespect you, your business, and the team regardless.

Putting in the work to reflect on your leadership style and that of your leadership team pays dividends. It aids in recruitment and fosters an atmosphere of respect and honesty.

Become known for a healthy, positive workplace and you’ll attract the best workers. Nurture that culture and the team will police itself; they won’t tolerate anyone harming the business.

Am I suggesting you view your business through rose-colored lenses? Absolutely not. Install security cameras. Maintain the right insurance coverage. Conduct regular inventory checks. Review comps and voids for irregularities. Limit access to cash. Outline what constitutes theft—including time theft—and make consequences clear.

And here’s a crucial item: Prove you respect and care about your workers. Not say it, prove it.

You don’t need to know their life stories and everything going on in their lives. But you can let it be known that if they’re struggling with something, you and your leadership team are there to listen and help how they’re able.

Nothing you do will eradicate employee theft completely. You can, however, reduce it and learn to quickly stamp it out. And you can do that while maintaining a happy, healthy workplace.

Image: Tobias Tullius on Unsplash